Updated: Nov 1, 2021

The $28 Trillion U.S. Debt: Which President Contributed the Most

Estimated read time: 12 minutes

Trillions With A "T"

The U.S. national debt is over 28 TRILLION dollars. That’s trillions — with a "T". As in 28,174 billion dollars. It’s terrifying.

It’s way more than the combined cost of World War II, the Korean War, the Vietnam War, and NASA’s entire space program since it started.

Which Presidents Are To Blame?

Of course, each political party points to the other. The fact is there’s no easy answer, because there are different ways to measure the situation.

The most popular method is to simply compare the debt level from when a president enters the White House to the debt level when he leaves.

After all, it’s your debt, too. You’re paying for this debt when you pay taxes.

We’re All In Debt Together

We’re constantly under assault by debt. We’re crushed under the weight of credit card debt. We’re up to our eyeballs in medical debt. We’re choosing between paying rent and student loans because it’s possible to be making minimum wage with an expensive college degree.

So what’s another 85K, right? A lot, actually.

If our country doesn’t correct its debt spiral, it risks defaulting on its obligations. That would diminish its power around the world.

It could also raise interest rates, reduce spending on government programs, and weaken entitlements like Social Security.

Since the US national debt now exceeds the gross domestic product (GDP), our economy seems to be headed off a cliff. Yet Congress keeps raising the debt ceiling, allowing the federal government to borrow more and more without paying it back. As citizens, we need to be better informed.

Does your personal debt feel as dire as our national debt? We can help.

See If You Qualify for a Personal Loan up to $250k

Why We Wrote This

We wanted to understand how individual presidents have affected the nation’s bottom line. We explored the presidents who’ve held office since 1981.

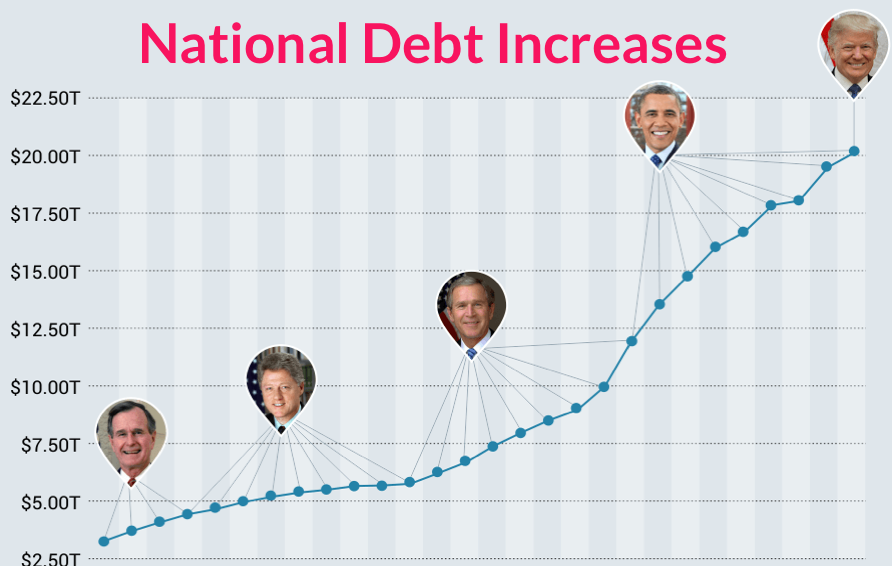

Measuring Presidential Debt

To understand a president’s contribution to the national debt, we first need to learn how it’s measured. The easiest way is to compare his first and last days on the job.

Daily debt numbers aren’t available before 1993, we haven’t used that measurement to compare the presidents since 1981. For instance, on the day that Barack Obama was sworn in—January 20, 2009—the debt was $10.626 trillion. When he left the White House on January 20, 2017, it was $19.947 trillion.

The Math That Seems Simple

Obama added $9 trillion in debt during his term. George W. Bush added $4.9 trillion. Bill Clinton added $1.5 trillion.

Debt statistics like those are ready-made talking points for cable news shows and stump speeches. But they can also be misleading.

Why? Because during a president’s first year in office, he doesn’t control the debt. He inherits his predecessor’s budget.

The budget for Obama’s first year in office was set by George W. Bush and during the 2009 fiscal year, it created a $1.16 trillion deficit. Bush had left the White House but it was the next guy who picked up the tab.

Comparing the numbers is simple. Knowing who the numbers belong to, and more importantly who to blame, is the useful information.

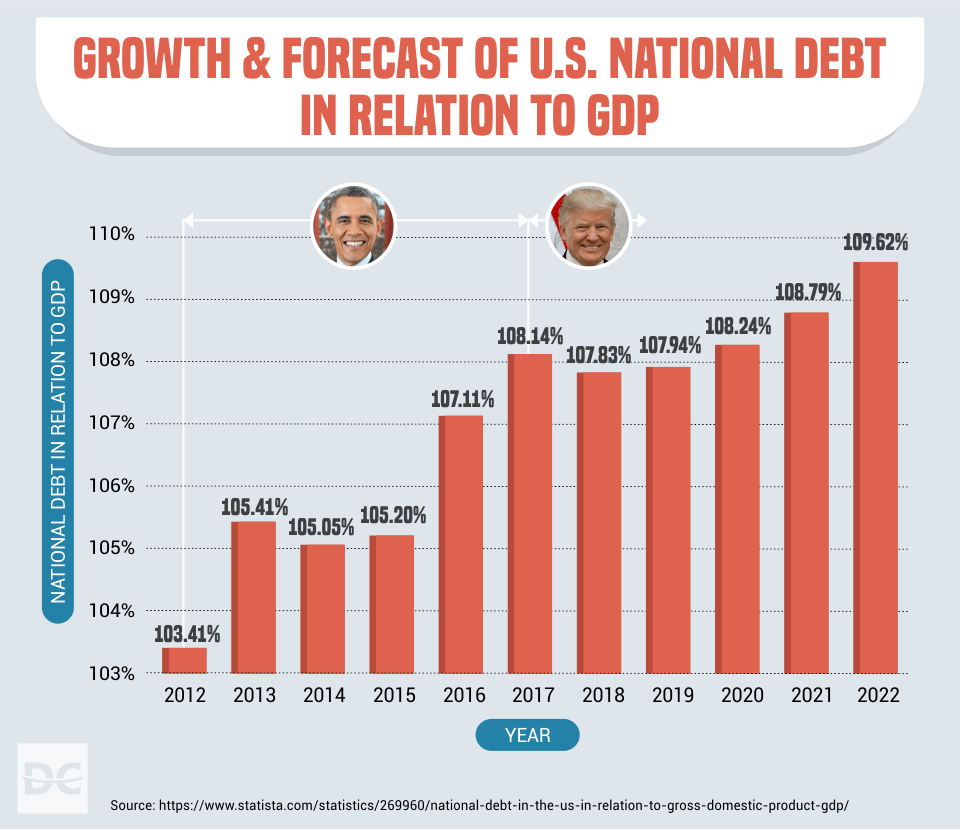

Debt-to-GDP Ratio: A Very Helpful Number

GDP (Gross Domestic Product) is the total output of all American businesses. It’s basically how much money a country makes.

Comparing the national debt to its GDP under a given president is a classic way to gauge a country’s economic health during that time.

- National Debt

- ÷GDP

- =Debt-to-GDP Ratio*

*The ratio is usually written as a percent

Money’s never quite that simple though. Debt and GDP go hand in hand. "You have to spend money to make money."

The world’s top economies are among its highest debtors. Japan, Germany and the U.S. all have plenty of debt. They also genrate lots of cash to go with it. A country with a high-powered economy can keep more debt than smaller countries while maintaining it’s credit rating.

What’s a normal Debt-to-GDP for the U.S.?

For most of US history, the Debt-to-GDP ratio has been under 50%. But that doesn’t tell the whole story.

U.S. debt at the end of World War II totaled $241.86 billion ($2.9 trillion with inflation). That’s far less debt than the 29 trillion the US has today.

Its debt-to-GDP ratio at that time however was also at an all-time high of 113%. In contrast, due to the COVID-19 pandemic and the CARES Act, the ratrio has increased to 129% as of 2020.

Confidence Isn’t Always About The Numbers

Ask yourself this: Do you feel confident that the economy is healthier in 2021 than it was during the Great Depression of the 1930’s?

You almost certainly do because the economy is healthier today. But when unemployment had reached 25% and middle class Americans were relying on soup kitchens to stay alive, the Debt-to-GDP ratio was only 44%.

Today it’s 129%.

The president of the United States makes tough financial decisions every day. Each move invites half the country to praise and the other to criticize.

If you want to feel confident about which side of the argument to join, you need context. Decisions aren’t made in a vacuum and neither should your opinions.

Here’s our break down the last 6 POTUS. Judge or forgive away.

Ronald Reagan

40th President of the United States

1981 – 1989

Budgets

- 1981: $678,241 million

- 1989: $1.143 trillion

- $1.5 trillion deficit

- Increased defense budget and expanded Medicare

- Highest deficits since wartime

Reduced Taxes

- Reaganomics’ failure to stimulate economy left goverment underfunded

- Slashed top income bracket rate from 70% – 28%

Recession

- Unemployment rate was 6% – 10%

- High interest rates triggerd down turn

Natonal Debt

- Increased debt by $1.859 trillion

Debt-to-GDP ratio

- Increased from 31% to 51%

George H.W. Bush

41st President of the United States

1989 – 1993

Budgets

- 1989 – $1.143 trillion

- 1993 – $1.409 trillion

- $1.188 trillion in deficits

War Spending

- Invaded Iraq

- Gulf War led to huge increase in military spending

Recession

- $125 billion for Savings and Loan Crisis

Natonal Debt Increase

- Defecits increased debt by $1.554 trillion

- Increased debt to $4.411 trillion by 1993

Debt-to-GDP ratio

- Increased from 51% to 64%

Bill Clinton

42th President of the United States

1993 – 2001

Raised Taxes And Cut Spending

- Only president since 1980 to leave office in 2001 with a balanced budget

- Decreased military spending following the Cold War

- New taxes fueled by the Dot Com Bubble increased revenue

Budget

- 1993 – $1.409 trillion

- 2001 – $1.862 trillion

- Instituted strict fiscal policies

- Reduced number of U.S. troops stationed around the world

The (Social Security) Surplus

- Left office with $36 billion surplus

- Critics feel surplus owed to Social Security tax on payrolls

GDP And Debt

- Increased debt from $4.4 trillion to $5.8 trillion

- Though the debt grew by 32%, it was a lower percentage of GDP

- The debt-to-GDP ratio decreased from 64% to 55%

A Booming Economy

- GDP skyrockets to over $10 trillion

Taxes Raised

- Top tax bracket rate increased to 39.6%

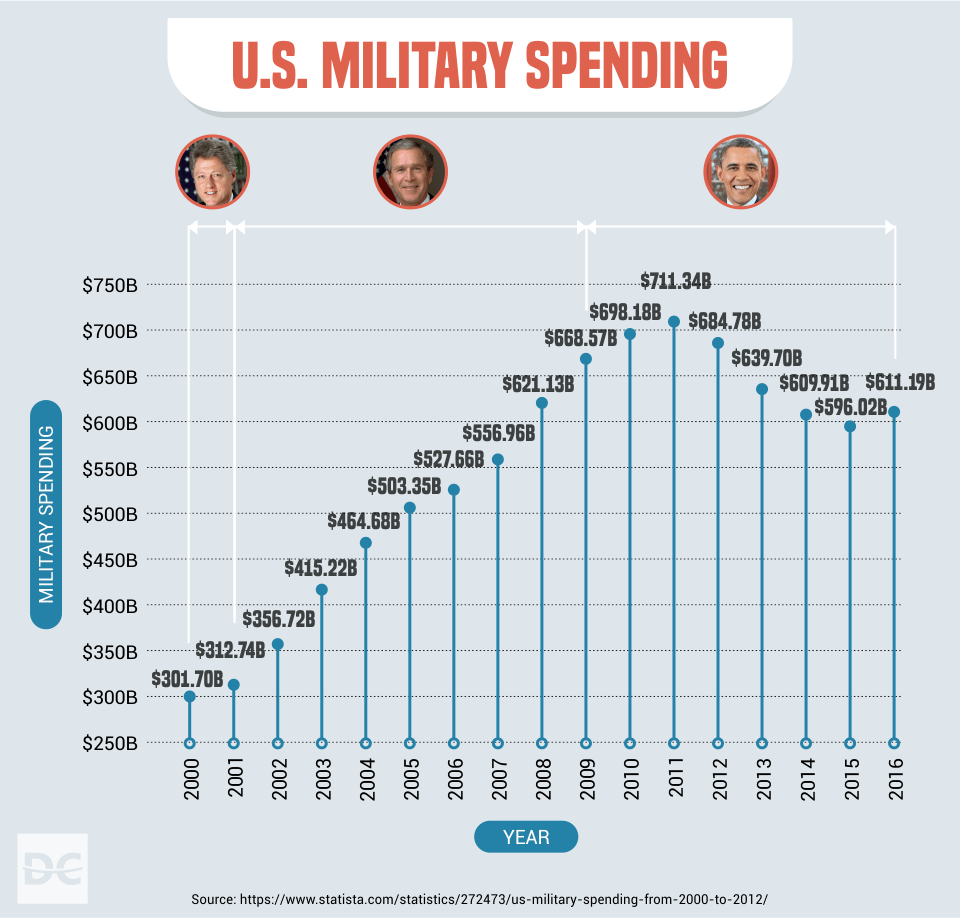

George W. Bush

43th President of the United States

2001 – 2009

9/11 – New Levels of Goverment Spending

The 9/11 terrorist attacks dramatically reshaped the U.S. economy.

- Military spending surged to $600 billion/year

- Afghanistan and Iraq wars primary cost

Budgets

- 2001 – $1.862 trillion

- 2009 – $3.157 trillion

- TARP adds $700 billion after housing crisis

- Deficits totaled $3.418 trillion

Reduced Taxes

- Cut taxes in 2001 and 2003

- Top tax bracket rate lowered to 35%

- Decreased government revenue

Recession

- Dot-Com Bubble burst

- Subprime mortgage crisis

- Widespread foreclosures increases avg household debt

Natonal Debt Increase

- Public debt increased by $6.103 trillion

- Billions added to debt by Medicare Part D prescription drug program

- Slowed cost of Medicare

Debt-to-GDP ratio

- Debt-to-GDP rose from 55% to 82%

Barack Obama

44th President of the United States

2009 – 2017

Budgets

- 2009 – $3.157 trillion

- 2017 – $3.981 trillion

- Military spending increased to approximately $685 billion per year to fund two inherited wars

- Deficits totaled $7.939 trillion

- Entitlement programs like Medicare and Social Security became more expensive with the againg population

Reduced Taxes

- Obama extended the Bush tax cuts to stimulate the economy and extended them through 2012. This added $858 billion to the debt

- Americans’ pay decreased during the recession causing tax revenue to fall

The Great Recession (2008)

- Upon taking office, the stock market had cratered and businesses were shedding jobs

- The American Recovery and Reinvestment Act was was passed as an economic stimulus package costing $787 billion

National Debt Increase

- Obama added $8.335 trillion to the public debt – more than any modern president

- In 2001, the public debt was 55% of GDP. By 2009, it had increased to 82%

- The Medicare Part D Bill was passed reduce the cost of prescription drugs. This added billions to the debt but slowed the cost of Medicare

Debt-to-GDP ratio

- The debt-to-GDP ratio grew enormously from 82% to 104%

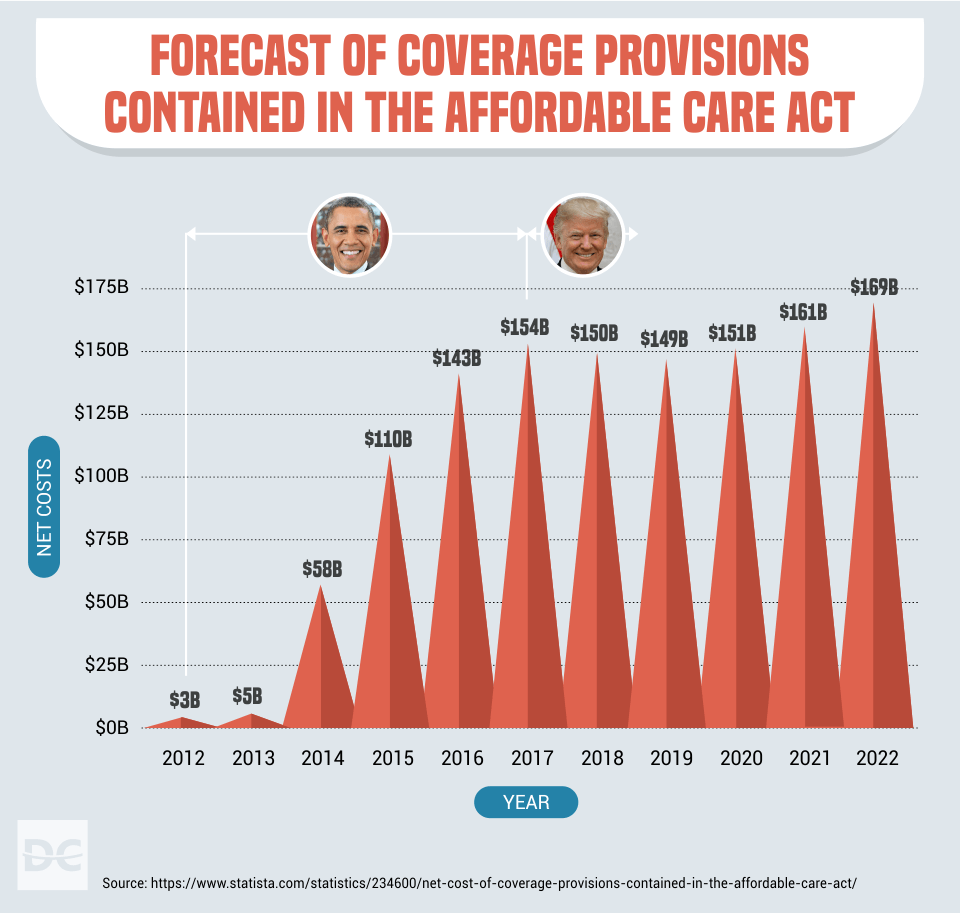

Obamacare

- The bipartisan Congressional Budget Office estimates that Obamacare (the Affordable Care Act) would reduce deficits by $154 billion over its first decade

Donald Trump

45th President of the United States

2017 – 2021

Budgets

- 2017 – $3.981 trillion

- 2020 – $6.550 trillion

- Increased annual spending by over 64% from 2017 to 2020, heavily impacted by the COVID-19 pandemic and the resulting CARES Act.

- Deficits totaled $5.557 trillion

Reduced Taxes

- Top income bracket tax rate reduced from 39.6% to 37%

- Nearly doubled the standard deduction to a new 2020 amount of $12,400

- Capped State and Local Tax (SALT) deductions to $10,000 annually ($5,000 for taxpayers filing seperately)

- Reduced the cap on Mortgage Interest Deductions from $1m in deductions to only $750,000

- Doubled the Child Tax Credit from $1,000 per child under 17 to $2,000 per child

- Doubled the Estate Tax deduction from a limit of $5.49 million to $11.18 million allowing wealthy families to transfer more money to their heirs, tax-free

- Removed the individual mandate for health insurance previously put in place by Obama and the Afforadble Care Act

- Deductions are no longer allowed for alimony

- 401(k) base contribution limits increased from $19,000 to $19,500

- HSA contribution limits also inceased. The limit for self-coverage increased from $3,500 to $3,550, while family coverage limits increased from $7,000 to $7,100

COVID-19

- The FY2020 federal budget deficit totaled $3.1 trillion, more than triple its FY2019 value, and the Congressional Budget Office projects the bills enacted in to increase deficits by $2.6 trillion

- Additional relief and stimulus was enacted in 2021 which CBO and JCT estimate would increase deficits by $1 trillion over the 2021-2031 period, $868 billion of which comes from COVID-19 related provisions. This was followed by the American Rescue Plan Act of 2021, which is estimated to increase deficits by nearly $2 trillion over the 2021-2031 period.

National Debt Increase

- Trump added $6.2 trillion to national debt in his four year term

Debt-to-GDP ratio

- The debt-to-GDP ratio grew enormously from 104% to 129%

You

The American Citizen

2021

Just like their government, many Americans are adding to their personal debt faster than they can pay it down. Household debt is at an all-time high. Does any of this look familiar to you?

Budget

- Living paycheck to paycheck (78% of us do)

- According to a Career Builder survey:

- Nearly one in 10 workers making $100,000+ live paycheck to paycheck

- More than 1 in 4 workers do not set aside any savings each month

- Nearly 3 in 4 workers say they are in debt – and more than half think they always will be

- More than half of minimum wage workers say they have to work more than one job to make ends meet

- 28% of workers making $50k – $100k usually or always live paycheck to paycheck, and 70% are in debt

-

Debt

- Credit card debt keeps growing

- Medical bills past due

- Student loan payments consume a good chunk of monthly income

- Over twelve milloin Americans each year leverage personal loan products to augment their financial situation

Your personal Debt-to-Income ratio

- Your The debt-to-income ratio is more than 100%