Updated: Nov 9, 2021

DebtMD Review

Estimated read time: 7 minutes

Overview

With high interest rates, it’s easy to get into credit card debt – and quickly. Many people turn to the use of credit cards to help make ends meet when cash is tight and unexpected events arise. If this sounds like a familiar situation, DebtMD may be able to help you find your way out.

DebtMD’s network of debt solution providers consists of the most reputable national lenders, credit counselors and debt settlement companies in the industry, covering all 50 states in the U.S.

While DebtMD can provide help for those in other types of debt, such as medical and student loan debt, their services seem to be especially appealing for those who find themselves with over $10,000 in credit card debt.

Why You May Need the Company’s Services

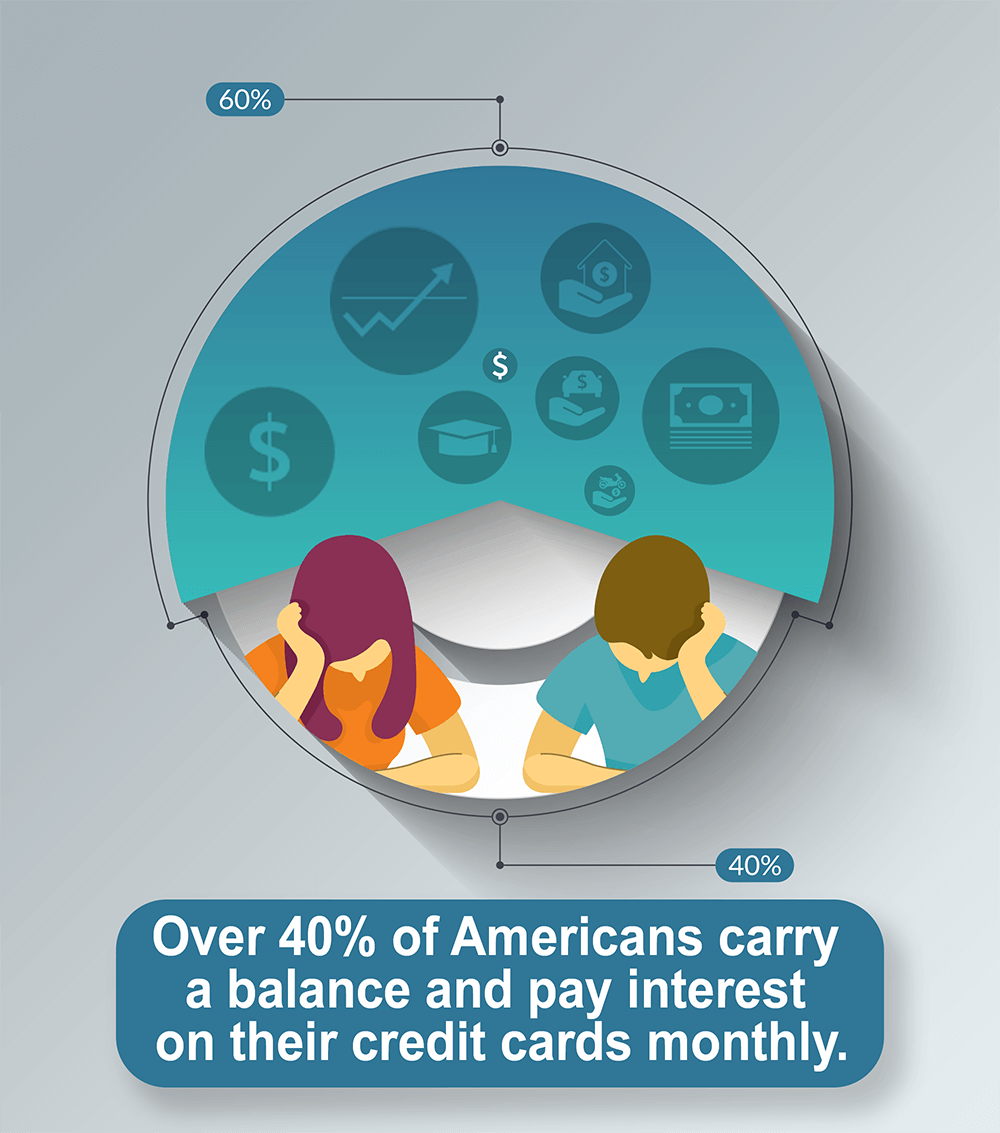

Current statistics show that over 40% of Americans carry a balance and pay interest on their credit cards monthly. Searching for solutions to mounting debt can be overwhelming. This can be especially troublesome for those with over $10,000 in credit card debt, whom DebtMD’s services are geared towards. Customers in this category should consider taking advantage of the tools available on their site to help get out of debt faster and pay less interest overall.

Many people who are trying to get out of credit card debt don’t know where to begin – especially if they owe money on multiple credit cards. Getting rid of your credit card debt matters for more than just your personal sanity. High credit utilization affects your ability to qualify for mortgages, be approved for auto loans, and numerous other major life purchases. Thankfully, there are options to help you tackle your debt if you can’t pay it all at once.

What People Love About It

Customers rave about DebtMD’s well-designed and easy to use website. Specifically, the 5-star reviews found on Google offer high praise for the design of their Smart Debt Analyzer and debt calculator tools. Customers felt as though these helpful tools enabled them to identify the best options for their debt levels.

Reviewers also noted DebtMD’s strong connections with some of the best companies in debt consolidation, and felt as though the partners listed on their site were thoroughly verified and accurately described. This can be especially helpful when trying to decide which debt resolution partner will best suit your specific needs and financial goals. The opportunity to actually speak to a customer service agent with DebtMD’s preferred partners was also deemed highly valuable.

Biggest Consumer Complaints

One caveat that customers may not be aware of initially is that DebtMD is not a licensed financial institution. Instead, DebtMD is a platform that connects people with reputable solution providers, which include lenders, credit counselors, and debt settlement companies.

Along with that, customers cannot obtain specific quotes for their debt resolution on DebtMD’s website. This part of the process occurs after the customer has chosen a DebtMD partner with whom they may potentially like to work with to pay off their debt.

As with many debt solution providers, going through the resolution process can often have a negative impact on your credit score.

How the Company Works:

Although DebtMD doesn’t provide financial solutions itself, it lists multiple companies where consumers can find relief in each of its debt categories, including medical debt, credit card debt, and student loan debt. These companies offer a variety of solutions, including debt consolidation loans, credit counseling, debt settlement, and refinancing.

DebtMD’s website makes it easy for you to apply filters to help refine your search, as you view their chosen partners. You can search by type of debt, the specific solution you are looking for, as well as providers who are willing to work with your credit score rating.

DebtMD also offers a variety of free financial tools for visitors to its website. These tools include a smart-debt analyzer that helps consumers find the solution that will work best for their particular situation, payoff calculators to help borrowers find out how long it will take them to pay off their debt, and monthly payment calculators that show borrowers how much they should pay each month to eliminate their debt in the desired amount of time.

Key Digital Services

One of the premier features of DebtMD is their proprietary Smart Debt Analyzer. The Smart Debt Analyzer™ utilizes a 30 second survey which allows individuals to input information related to their credit score, income, and types of debt. The tool’s technology then instantly matches their unique financial profile with a number of personalized debt solutions to choose from.

DebtMD also provides access to several easy-to-use tools which can help you estimate minimum payments, as well as a payoff calculator. Alternatively, you can bypass the analysis steps, and go directly to their directory of debt relief providers listed on their site, where you can filter by type of debt, solution, and credit score.

FAQ’s about DebtMD

How long does it take for their debt settlement program?

Programs usually last 24-48 months.

What debts do they help resolve?

DebtMD specializes in helping customers resolve credit card debt

Can they help my credit score get better?

Credit repair isn’t typically included in your debt settlement program, but some companies do offer this as an added service once you complete the program.

How do they affect my credit?

Since the debt settlement company negotiates settlements of your credit card balances on your behalf, part of the process involves withholding payments to your creditors. For this reason, you will experience a temporary negative impact on your credit score. However, once you are debt-free, you will be able to establish credit once again.

Can I cancel anytime?

Yes, you can cancel anytime. You are under no obligation to remain in the program if you don’t want to.

Can I monitor my results through DebtMD?

No, but you can monitor your progress and results in the program through the company you are working with.

Where can I monitor my account and my progress?

Most debt settlement companies have a portal in which you can log in and track your progress.

Do they dispute erroneous and negative items to the companies on my behalf?

No, that is an added service (usually provided by credit repair companies) that a debt settlement company may or may not offer.

What are the advantages of going with DebtMD?

DebtMD’s core values are transparency, integrity, and education. They educate consumers on the various debt relief options so they can make an informed decision as to what is best for their unique financial situation. In addition, the companies on their site go through a rigorous vetting process; they only partner with companies who have the consumer’s best interests at heart.

How is DebtMD different from other companies in the same field?

Other companies sometimes push consumers into options that might not make the most sense for their financial situation. DebtMD informs and educates its users on each debt relief option, so they can choose the best one with confidence.

How safe and legitimate is DebtMD? Is my information safe with them?

DebtMD takes the privacy of their users very seriously. They do not gather any sensitive user information, and the information they do collect is not shared or sold to any third parties.

What is the guarantee for their services?

The reputable debt settlement companies that they partner with only take their fees upon reaching agreements with your creditors. So, they only get paid if your debts are resolved.

Should I expect to be debt free by the time we are done?

If you make all of the scheduled payments as outlined in your service agreement, the likelihood of you graduating your program on time is very high. Some programs may take shorter or longer due to other factors such as you pre-paying or missing a payment.

How much in debt should I be before I seek out their services?

DebtMD specializes in helping consumers who have more than $10,000 in credit card debt.

Final Opinion

While DebtMD doesn’t provide debt relief services itself, it can be a helpful first step for consumers who don’t know where to start. And even customers who don’t end up finding a debt solution provider through DebtMD will probably find the DebtMD website helpful thanks to its financial tools. On the other hand, customers who already have an idea of what company they want to use, or who need urgent relief, may be better served by contacting debt relief companies directly.

DebtMD.com is a reputable site that has been featured by Forbes, U.S. News and World Report, Fox Business, and Yahoo Finance. They offer confidence to consumers with their core values of transparency, integrity, and education. Their service is free to use, but there may be fees associated with the actual debt relief provider that you choose. Make sure to read the fine print from any debt solution offer you may receive.