Updated: Nov 3, 2021

We Analyzed 1 Million Debt Consolidation Articles (And This is What We Learned)

Estimated read time: 22 minutes

I started DebtConsolidation.com after I kept noticing a recurring pattern that upset me:

People find it easy to get into debt, but extremely difficult to get out of it.

Most people are simply not informed enough when it comes to properly handling their debt.

They don’t know their options, so their debts don’t get paid off.

The debt continues to pile up and they struggle just to maintain minimum interest payments.

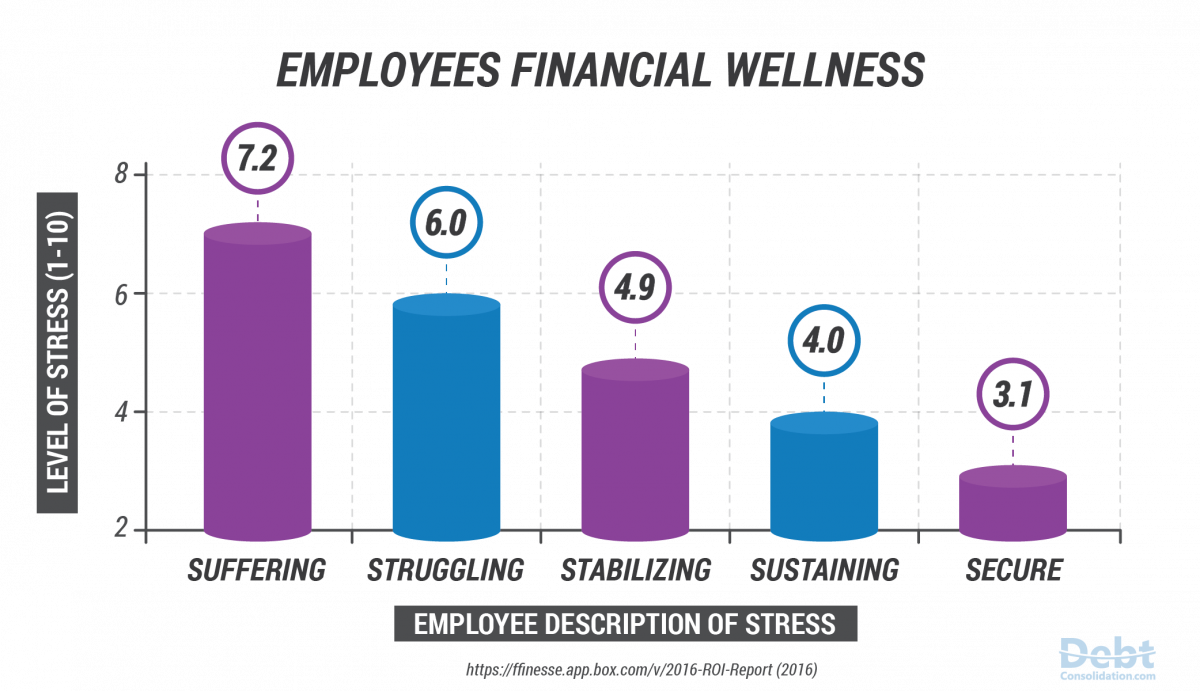

You can only imagine how much stress this is causing them.

And that’s what upsets me.

Because I know there are solutions out there—like debt consolidation options—that can help them climb out of the hole they’ve dug for themselves.

I started DebtConsolidation.com to help folks in this kind of situation.

I want to help them learn about their options and connect them with the resources they need to manage their personal finances and get out of debt.

If you’re experiencing stress over debt, you shouldn’t feel alone and in the dark.

My long-term mission for this site is to create a community where debt-stricken individuals can find sound financial advice and much-needed support.

And shine a light on the path and solutions they can take towards financial stability.

If you’re struggling with debt, understanding all the options and best practices for debt consolidation can give you a huge boost towards your goal of becoming debt-free.

The problem is, there are over 1 million debt consolidation articles on the internet.

Most people don’t have the time to read through them, let alone understand each one.

So let me offer some help.

We’ve taken the time to analyze the 1 million+ online articles dealing with debt consolidation.

We got page after page of results when we searched "Debt Consolidation" on sites like Webio and Ask.com.

We distilled that huge amount of online information down to what we felt were the eight most important debt consolidation lessons and best practices for you to benefit from right now.

Once you become familiar with all these strategies for handling and consolidating debt, I’m confident your stress level will decrease as you won’t have to worry so much with a plan of action to guide you along.

So even if you’ve failed in your past attempts to eliminate your debt, there is definitely hope for you to find lasting solutions.

Apply as many of these tips as you can to alleviate your current debt situation, and soon you’ll be on the path to becoming debt-free.

Getting Started

Evaluate your debt so you can understand the problem

One theme that emerges again and again in online articles on debt consolidation is the importance of self-evaluation.

In short, knowing what you’re up against is already half the battle.

Consumer debt in the United States is slowly getting closer to the all-time high it hit back in 2008.

There’s a good chance you’ve got debt spread out across all sorts of different accounts and lenders.

If you’re going to consolidate your debt, you have to know what balances are currently outstanding and what you’re paying each month.

Here are eight forms of debt for you to self-evaluate.

Once you’re fully aware of the various forms of debts you have, you can address them all at the same time with an effective debt consolidation plan.

Credit card debt is easy to rack up. When most people open a new credit card, they promise themselves that they won’t carry a balance.

But the commitment to pay credit card debt off in full every month is an easy one to let slide—especially if you get an unexpected expense like a vet bill or car repair.

If it doesn’t get paid off, credit card debt can start feeling like a weight around your neck that keeps getting heavier.

Student loans don’t pay themselves off as fast as most people hope. When you got your student loan, you probably figured you’d get hired at a great job right out of college.

But it often doesn’t work out that way, and paying off student loans with an entry-level salary can be a real challenge.

I had no credit during college and I only started to look after my score after I found some decent employment.

But silly things like forgetting to start paying back my student loans absolutely crushed the momentum of whatever credit I was building at the time.

A hard lesson to learn, but later on you’ll see there are more options nowadays compared to when I was a student.

Unsecured personal loans are almost too easy to get. Many people turn to an unsecured personal loan when they are stuck for funds.

That includes payday loans and other loans that don’t require collateral.

But without education on the ins and outs of personal loans (like I’m providing you with here)this kind of credit can come back to bite you.

Car loans get you on the road. But they can cost you so much in interest you might feel you’ve paid for your car twice—which is often the case if you sum up the payments!

Medical bills are often unplanned. But taking care of yourself and your family’s health isn’t optional, so going into debt to cover them is sometimes necessary.

Cell phone and home utility bills don’t stop when your funds get low. Being late on bill payments hurts your credit score. Also, if you don’t pay, you risk getting disconnected from vital utilities or slapped with penalties or other fees.

Collection agencies constantly remind you of what you owe. Paying them is the only way to make them go away.

Tax bills are not something you can ignore. Uncle Sam doesn’t like it when you don’t give him his share.

Legal problems or even jail time can arise as a result of not paying.

Court-ordered payments can sting. But the judge usually doesn’t ask if you can afford them.

Different debts will be sitting with different statuses.

Some debt might be old and almost paid off.

While other debts might be newer with no end yet in sight.

You could even be dealing with the fallout from a debt that you failed to keep on top of.

The first piece of best practice advice we pulled from the online research we performed is to do a thorough inventory of the various forms of credit you are carrying and the status of each debt.

I’ve developed a simple tool for measuring your debt. Now that you’ve identified the different areas of debt you’re experiencing, I want to make it easy for you to measure them all together.

Visit DebtConsolidation.com’s online Debt Consolidation Calculator and start plugging in all of the various debts you owe to lenders.

Include the balances you owe, the interest rate you’re being charged, and the monthly payments you make.

For loans with fixed payback periods, you will also indicate how many payments you have remaining.

For credit card debt, you can choose to make your calculation based either on minimum payments or what you’ve budgeted to pay every month.

Once you’ve added up all your debts using the calculator, it will give you a New Consolidated Loan comparison.

Compare your present with your potential future. Your New Consolidated Loan Balance will be the total of all the outstanding debt you entered into the calculator.

The Monthly Payment it calculates for the New Consolidated Loan could be significantly less than what you’re currently paying each month.

For example, if you’re payments total $720 every month on a total combined debt of $21,779, the monthly payment for a consolidated loan could be just $300.

An interest rate will also be calculated for the New Consolidated Loan, which will ideally be less than the weighted average of the interest rates you are paying on all your existing debts.

You’ll also get a breakdown of how many months it will take you to pay down your debt at your current rate, compared to the potentially shorter amount of time it could take with a debt consolidation loan.

Once you’ve completed this exercise, you’ll have a firm understanding of your existing debt and what you’re paying just to stay on top of it.

But what’s even more valuable are the comparisons you are given between your current debt reality and the possible terms you could be enjoying with a New Consolidated Loan.

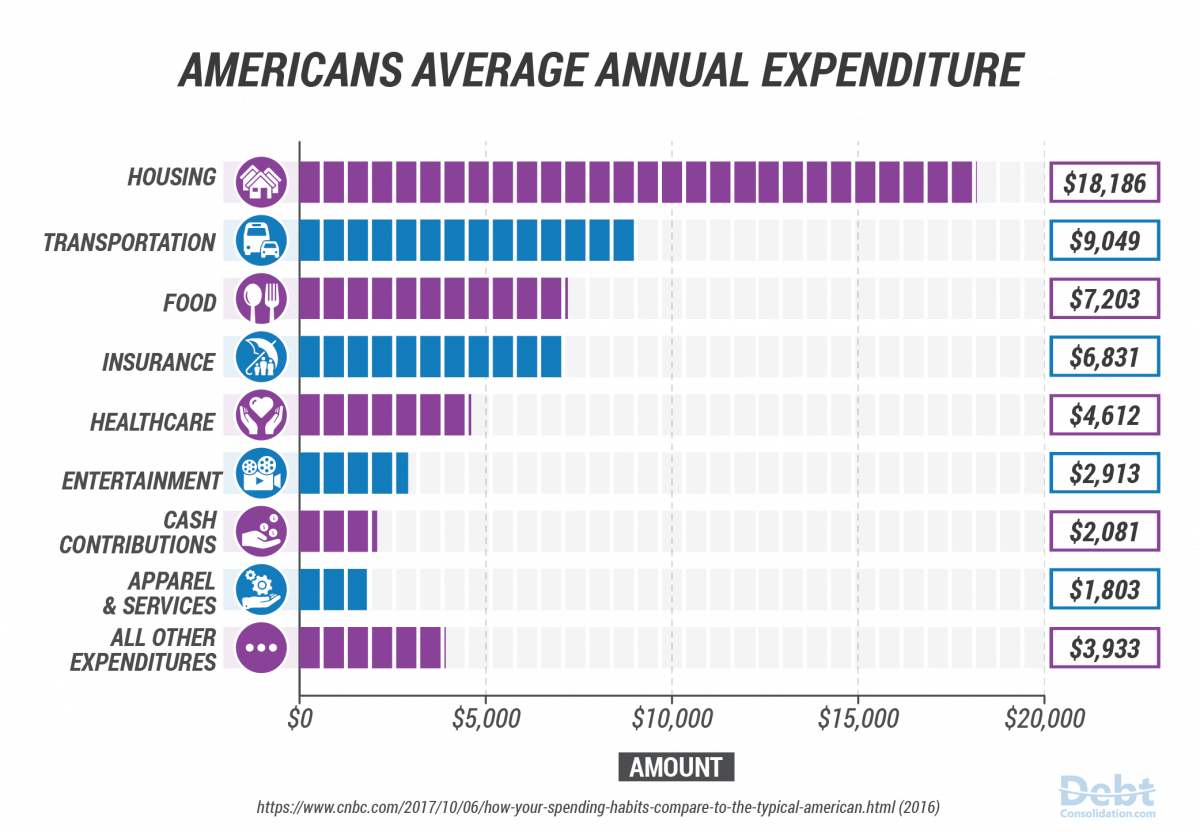

Calculate your expenses to get control of them. Another important self-evaluation recommended in the online materials we’ve surveyed is with your spending.

Most of the debt consolidation options available will help you better manage your existing debt.

But it’s also important that you ask yourself what spending habits might have gotten you into debt in the first place.

I’ve developed another super-handy tool to help you out with that.

Plug in everything you spend and compare. DebtConsolidation.com has a personal spending calculator that lets you add up how much you spend on everything from rent and utilities to pets and restaurants, and compare your total to the national average.

Calculating your monthly expenses could be an eye-opening exercise for you.

With it, most people are able to identify potential areas where they could cut back on their spending.

This contributes to your long-term sustainability after your debts eventually get cleared up.

Get your credit report prepared for loan offers. Finally, the last piece of advice we gleaned from the online literature is to evaluate your current debt and credit situation by getting a copy of your credit report and credit score.

There are three credit bureaus that collect data on your credit behavior, Experian, Equifax, and TransUnion.

You’re allowed to request a free report from each of them once a year.

Together, the reports collected by these three agencies are used to calculate your FICO credit score, which is like the GPA of the financial world.

Having a good score could be the difference between driving your dream car and settling with your parents’ old station wagon.

Your credit score will impact the rates you receive. It’s pretty easy to get your FICO Score at no cost.

Credit card issuers, financial institutions like banks and credit unions, and other lenders can often provide you with your credit score at no cost.

Your FICO Score is considered a representation of your creditworthiness.

The interest rate you are offered for a debt consolidation loan will largely be based on your credit score.

As you move on to apply the next couple of tips, it’s going to be important for you to know your credit score, since you can expect the credit sources you qualify for and the interest rates you’ll be offered will be heavily based on it:

- An "Excellent" score is between 750 and 850

- A "Good" score is between 700 and 750

- A "Fair" score is between 650 and 700

- A "Bad" score is between 560 and 650

- A "Very Bad" score is below 560 and as low as 300

How to Choose the Right Option

Be aware of all your debt consolidation options to choose the right one for you

You also need to be aware of all the options that are available to consolidate your debt.

Here are some of best strategies our online research on debt consolidation revealed.

You might have the power to pay down your debts all on your own. Sometimes it’s just a matter of doing the math and changing your budget.

If you prioritize paying off your debt more quickly and make some sacrifices to reduce your monthly expenses, you could create a timeline to pay-off your debts without needing to access new credit.

The research we did also indicates some success when people call their creditors and simply ask for better rates.

For example, you can call your credit card company and ask them if you could get a lower APR.

If you’ve been a good and longstanding customer, they might just say yes.

There are credit counselors available who can help you create abudget and timeline for getting out of debt.

A great place to start is the National Foundation for Credit Counseling, where you can find listings for trustworthy credit counselors.

A balance transfer can help manage a high-interest balance. Some credit card offers are designed to specifically attract people who are paying high-interest rates by offering a 0% APR for a limited period on a new card.

Many balance transfer credit cards provide an introductory APR period of 0%.

When you transfer a balance from a high-interest card you can get 12, 18, or even 21 months with 0% APR.

After the intro period is over, though, the interest rate can be just as high as any other credit card you apply for.

And you usually have to pay a balance transfer fee of 3% or even 5% on the balance you’re moving to the new card.

A home equity loan can let you re-borrow from your first mortgage. If you’ve been making mortgage payments it means you probably have some equity in the home you own.

You can borrow back some of the amount you’ve put into your home through a Home Equity Line of Credit (HELOC) or a home equity loan.

Usually, the interest rates for home equity loans are comparatively lower than most other credit sources, ranging 3–4% on average.

But it means you’re going to pay interest on the amount you re-borrow all over again.

To get a home equity loan you need to fill out an application and show the lender that you will be capable of making the regular monthly payments.

Then your home will be appraised to determine its value and the amount of equity you own.

You are usually allowed to borrow up to 80% of the equity you own in your home.

Debt settlement can negotiate a lower total payment. Your debt situation might be so dire that you can’t qualify for a debt consolidation loan or any of the other options we’ve listed here.

If that’s the case, the online articles we reviewed unanimously recommend you should talk to a debt settlement service.

They will contact your creditors and negotiate a one-time lump sum payment for your outstanding debt.

It will be less than what you owe because the logic is that the creditors won’t get a penny if you go bankrupt.

Even getting half of what you owe is better for them than getting nothing.

Contacting a debt settlement service like National Debt Relief should only be considered as a final option after looking at all the other choices.

It will majorly hurt your credit score, but at least you won’t have to file for bankruptcy.

All About Debt Consolidation Loans

They simplify and erase debt to make repayment easier

When we reviewed over one million online articles on debt consolidation and credit repair, we found overwhelming evidence in support of one of the most common strategies for personal debt consolidation.

Time and time again, the articles we came across identified taking out a debt consolidation loan as the single most robust and effective strategy for debt management.

But our research also shows that debt consolidation loans are not for everyone.

Here are some tips you can use to determine whether an unsecured personal loan is your right choice for debt consolidation.

No collateral? No problem. If you don’t have access to collateral or if you don’t want to pony up any collateral to get a loan, then an unsecured personal debt consolidation loan can be a good option.

You won’t get the best rate. Personal loans for debt consolidation are not going to offer you the lowest interest rate.

If low interest rates are your top priority you should be looking into a home equity loan.

One loan is easier to manage than multiple loans and payments. If you’re getting burnt-out keeping up with different payment due dates and submitting different payments, a debt consolidation personal loan is a great option.

All your loans get combined into one loan, with one payment and one due date.

There will only be one interest rate on all your debts. High-interest rate debts, like credit cards, can make it challenging to pay off balances in a reasonable amount of time.

If you want to pay off your debt faster, pay-off the high-interest balances with a debt consolidation loan and start paying everything off at a single, lower interest rate.

It’s hard to know where to start. With multiple sources of debt—ranging from student loans to credit cards and car loans—it can be hard to decide where to begin.

Some research say you should pay the smallest balances off first and then work your way up.

Other schools of thought suggest just the opposite.

The easiest thing to do is consolidate all your debts under one loan and pay them off together.

Not only is it more straightforward, but you will also probably pay your total debt down quicker.

Shop around for the best debt consolidation loan

If you followed best practice tip #1, you’re completely aware of your entire debt situation.

You’ve even seen the calculations for a New Consolidated Loan to manage all your existing debt at once.

You’re also aware of your credit report and the credit score that lenders are going to look at when they offer you new debt consolidation loan terms.

If you followed tip #2, you’ve also considered all the options that are available for you when it comes to consolidating your debt.

If you’ve followed tip #3 and concluded that you’re the perfect candidate for a debt consolidation personal loan, the next tip the research suggests is to start shopping around for a good loan.

Find the terms that work best for you. You’re going to be looking for the loan with the best terms for your debt, your credit score, and your budget.

We’ve discovered some really useful best practices from our review of over 1 million online articles on debt consolidation.

Here are some of the best tips:

Don’t pay a fee to apply. You should never have to pay a fee to apply for a loan.

If a lender you are approaching demands you pay them to review your credit and consider your application, look elsewhere.

Never pay any fees upfront.

Get a fixed rate so you can plan accurately. Fluctuating variable interest rates make it a challenge to budget over the longer term.

If you make sure you get a fixed interest rate, you’ll be able to predict exactly what your future payments will be.

Settle for a fixed term and make sure there’s no pre-payment penalty. Debt consolidation loans are typically short, from 1–5 years.

Establish a reasonable term for paying back your loan.

But avoid loans that charge something called a "Pre-payment Penalty."

That’s when lenders protect themselves against losing money on interest by charging you if you’re able to pay your loan off early—meaning you won’t get to save much on interest even if you paid in full ahead of schedule.

Avoid paying an origination fee to save a lot of money. Some lenders charge an origination fee, which means you are being charged to find the loan in the first place.

Common personal loan origination fees are usually around 0.99–5.99%.

To put that into perspective, a $5,000 loan would cost $299.50 if the lender charged a 5.99% origination fee.

However, there are lenders out there who don’t charge an origination fee.

You should lean towards those lenders if you qualify.

Go with the lowest interest rate you can find to save money over the loan’s term. This one might seem obvious, and that’s why it comes up in the research so frequently.

Compare interest rates among the various lenders and choose the lowest one.

But also make sure you’re taking into consideration other fees and costs over the life of the loan.

Set goals so you can get yourself out of debt and stay there

Okay, so you listened to the experts’ advice and got yourself a debt consolidation loan.

Yes, you made a good decision, but that doesn’t mean it’s a cure-all.

Be careful you don’t get too comfortable. Unfortunately, there is a lot of evidence indicating that for many individuals who took the debt consolidation route, it is only a matter of time until the debt creeps back into their lives.

The next few tips we gained from our research will help you make choices that continue to improve your situation.

A debt counselor can help in more ways than one. I’ve already mentioned that it might be a good idea to meet with a debt counselor as part of your journey to consolidate your debts and become debt-free.

Set your repayment goals and stick with them. Firstly, debt counselors can be very helpful in advising you about what kind of loan you can afford.

They will work with you to put together a payment plan and a schedule for you to pay off your loan if you are consolidating your debt.

Change your habits. But perhaps even more importantly, a credit counselor can help you fix the root causes of your debt problems.

Bad credit behavior is likely what got you into debt problems in the first place.

So, getting some coaching to change your behaviors so you can attack your debt most effectively can be very helpful.

The debt counselor can help advise you on a lot of things that influence debt.

For example, they can help you establish a household budget that you can stick with so you’re not spending more than you are bringing in.

The information we collected on debt consolidation suggests some specific steps you can take right now to get closer to your goal of becoming debt-free:

Budgeting helps save money. Households should make a budget and stick to it.

They should also use it to guide and track the household’s spending.

More income means less debt. People experiencing significant debt should consider getting a second job or other strategies for getting more income.

Use cash only and stop borrowing. Create a ‘cash only’ policy for you and your household.

You’ll be protecting yourself from adding to your existing problem with more credit card debt.

Live modestly. It might be tough to make changes to the lifestyle that you have become used to.

But some habits contribute a lot to debt.

You can start with cutting down on dining out and other entertainment expenses.

When we looked at all the research on debt consolidation, we discovered some really great tips out there for staying out of debt.

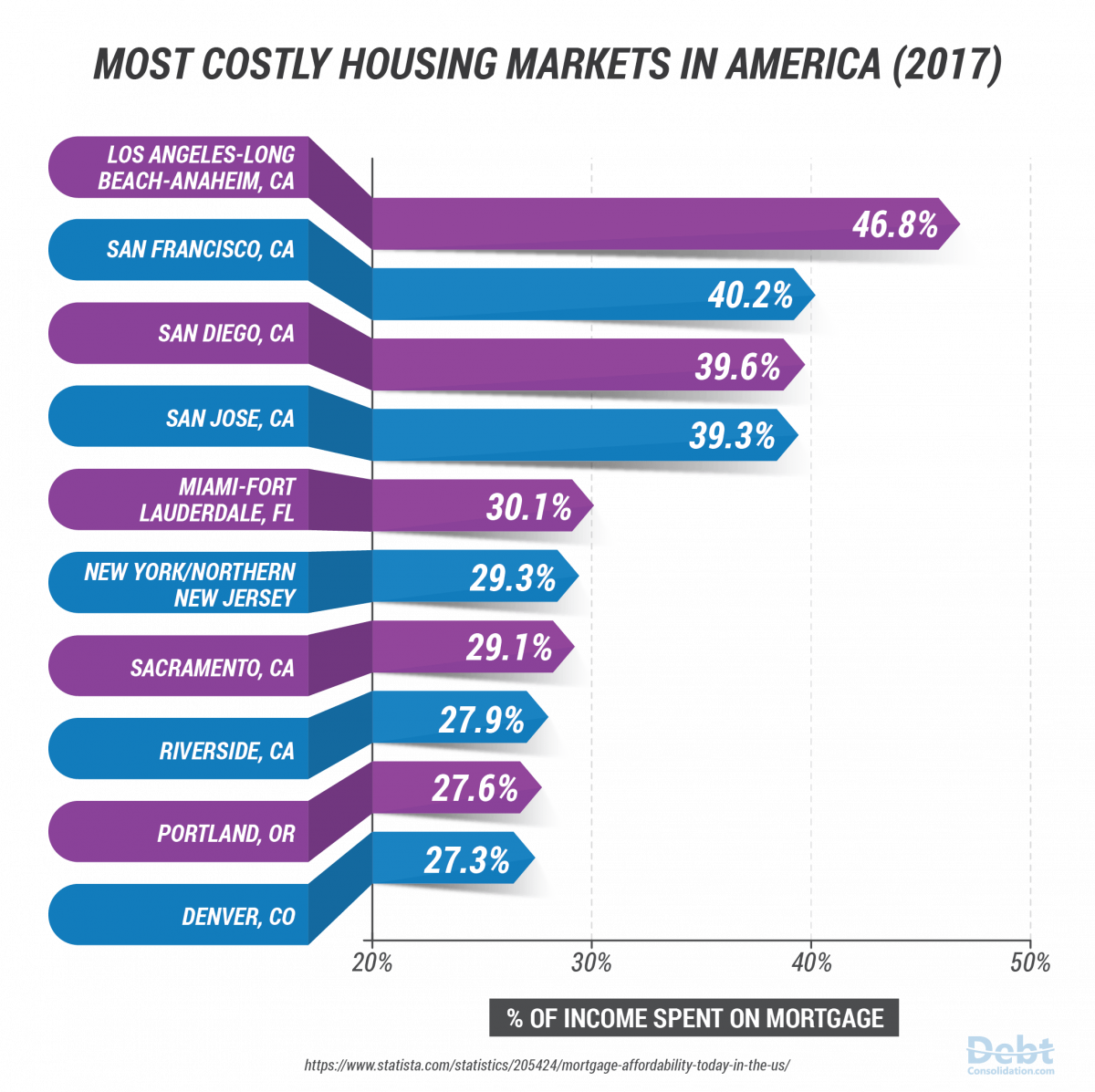

Moving to a cheaper state is an option.

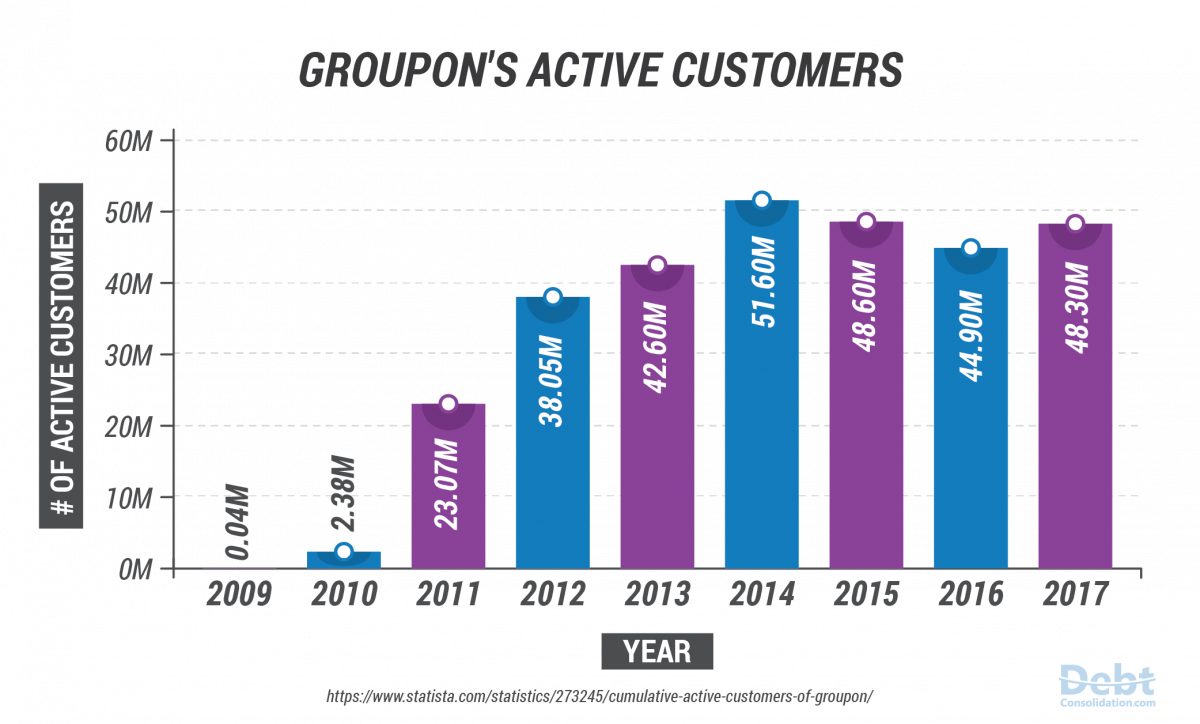

Using daily deal websites like Groupon is also recommended for scoring deals on entertainment and eating out.

Create a debt management plan. A debt counselor can work with you to put together a debt management plan.

You should expect it to take from 2–5 years to get out of debt, but with enough dedication on your part, you can definitely do it!

Make decisions that help increase your credit score

I already broke down what a credit score is and the factors that contribute to its calculation.

Your credit score is a factor in you qualifying for a debt consolidation loan and the interest rate you’ll get offered.

Top credit score marks for good behavior. Once you free yourself of your existing debt, the research suggests there are a few important moves you need to make to help improve or preserve your credit score.

Ultimately, once you have paid off your debt consolidation loan, you might be in a position to get a mortgage or other forms of credit, so a good credit score will be useful by then.

But credit scores are also commonly looked at by employers and landlords.

So, it’s important to pay attention to your credit score even if you don’t plan to borrow in the future.

Don’t cut up your credit cards. I know it would be really satisfying to take that credit card that you were struggling to make payments on, and just cut it right in half.

But the research reveals that cutting up your existing credit cards would not be a good move, at least when it comes to your credit score.

Keep your cards once you’ve paid them off with a debt consolidation loan.

Remember how 15% of your credit score is based on the length of time you’ve had your credit?

The longer you keep existing accounts open, the higher you’re going to score in that category.

Keeping credit card accounts open also helps with the "Amount Owed" credit score category.

30% of your overall score is based on this factor.

An empty credit card can be a good thing. It’s not just about the total you owe.

It’s also about how much of the credit you have available that you use.

It’s called "credit utilization ratio."

If you have available credit that you are not touching, it’s a good sign on your credit report and your score will increase accordingly.

Don’t use the credit you freed up with your debt consolidation loan to create new debt

Time to get disciplined. You’re going to need discipline to get out of debt and stay out of debt.

The discipline to keep up with your single monthly loan payment is absolutely vital to your success.

Otherwise, you’ll be falling behind again, this time on the loan you took out to pay off debts you were falling behind on.

Just because you have available credit doesn’t mean you should use it. The other discipline you need to exercise is to not use the credit you freed up to create new debt.

The research backs this up.

It’s easy to get a false sense of security once you’ve cleared off a bunch of debt on credit cards, student loans, and other sources of debt.

Tip #6 encouraged you not to cut up your credit cards, but it would be even worse if you started accumulating debt on them again.

You simply have to develop the discipline to just say ‘no’ to using that available credit.

Use new income wisely and you can have it all

Unexpected money often gets squandered. The research indicates that for many who are digging themselves out of the hole of debt through consolidation, an unexpected financial windfall often gets mismanaged.

Whether it’s an unexpected bonus at work, inheritance, or gift of money, there are choices you can make to further improve your debt situation.

Don’t let this new money make you overconfident. Take the money and manage it strategically.

One expert recently contributed a tip for a story on how to get out of debt posted on DebtConsolidation.com.

He recommends breaking a big check into thirds.

One third goes towards paying off existing debt, another third goes into your savings account, and the final third you can use to make a major purchase.

You can sleep better at night knowing that you were able to make an major purchase and didn’t have to access any further credit to get it.

We identified three themes out of the 1,000,000+ articles on debt consolidation available online

There are three big takeaways that all the best practices we’ve listed here can be organized within.

1. Understanding your debt helps you to manage it. Get your credit score and credit report.

Do an inventory of all your various debts and the status of each.

Calculate what you spend every month.

Then take that information and use it to determine whether debt consolidation is right for you.

If you decide it is, then take your data and use it to figure out what debt consolidation strategy is going to be best for you.

Access a debt counselor if that will help you fully understand your situation.

2. Think carefully about the debt consolidation option that’s right for you. Our review of the online articles on debt consolidation has revealed that there are multiple options available.

Some people might find that they are able to get out of debt without any debt consolidation product or service.

It takes planning, discipline, and often sacrifice.

Credit card balance transfers are widely available.

But make sure you can pay the balance transfer off within the 0% APR intro period or you will soon be paying full APR on your debt.

For people who are in a position to take advantage of the money, they have paid into owning their home, a home equity loan offers a low-interest rate.

Debt settlement is an option for people who are on the brink of bankruptcy. Make sure you find a reputable service.

Then let a professional negotiator work out a lower payment to be paid as one lump sum.

Your creditors will be happy to get something rather than the nothing they would get if you filed for bankruptcy.

If you want to bring all your debt under a convenient single payment and interest rate, and if you want to pay your debts down quicker in the most straightforward way, a debt consolidation loan is for you.

When you’re ready to apply for a debt consolidation loan, the research recommends a few guiding principles when you’re shopping around:

Get a fixed rate loan with a fixed term and no penalty for paying it off early.

Don’t pay your lender a fee for applying or an Origination Fee.

And of course, look for the best interest rate, but don’t sacrifice other important terms to get it.

3. Make the right choices after you consolidate your debt. That means, keep yourself out of debt permanently.

We found a lot of articles emphasizing how important it is to make the right choices after you consolidate your debt.

To stay financially healthy and avoid being overwhelmed again by debt, several important best practices emerged.

The right choices to improve or preserve your credit score were identified.

Most importantly, people who have cleared a credit card debt are advised to keep the accounts open to maximize their credit utilization ratio.

The discipline that you’ll need when you have unused credit cards lying around was identified.

You should keep the cards open, but the challenge is not to use them!

Accessing a debt counselor to help with budgeting, changing habits, and planning for the future was highly recommended in the research.

Getting all your debt consolidated is an accomplishment, but you must not throw it away by falling into the same habits that got you into debt in the first place!

I started DebtConsolidation.com because I observed a lot of unnecessary stress among people who found it easy to get into debt but impossible to get out.

I saw it again and again, so I decided to do something about it.

Besides doing the research of 1 million articles, through these brands I’ve created we’ve been helping to educate consumers on financial issues while providing the tools and solutions they need to effectively manage these issues.

As more and more people access our site and connect with the information and resources they need to consolidate their debt, I am getting closer and closer to my goal.

Together we’re creating a community of support so no one will feel alone or in the dark when it comes to debt.

That’s the best way I can think of to help alleviate the kind of financial stress I have witnessed too many times.

I encourage you to go out right now and apply as many of the above tips as possible to your own debt situation.

I am sure that you will be able to improve it through debt consolidation.

Hopefully, you will be able to live life on your own terms when you’re eventually debt-free.

We’re also interested in hearing your stories about your own debt consolidation loans.

Do you know any best practices for debt consolidation loans we’ve missed?

Have you had success getting out of debt via a debt consolidation loan?

Do you have any tips for staying out of debt once you’ve got your debt consolidation loan?

Please feel free to comment them below, we’d love to hear your opinions and first-hand experiences!