Updated: Nov 5, 2021

14 Invaluable Habits: What to Do With Your Money

Estimated read time: 17 minutes

Americans are terrible with money. Many have no savings to fall back on and are buried in debt.

In our consumer economy, it’s no surprise that we spend too much. Buying a new house or the latest phone is practically ingrained in the national psyche.

Spending beyond our means is as easy as swiping a credit card.

The average borrower has $2,859 in credit card debt. American household debt is worse than ever before: a staggering $12.73 trillion.

Bad financial habits are easy to get into but hard to break. They create recurring problems that lead to long-term damage.

Families who don’t buy health insurance can go bankrupt. Failing to save for retirement can leave older adults destitute.

Nearly half of American families have no retirement savings at all. Nor do they have the money to cover a $400 emergency.

Here’s the good news: Personal habits largely determine the state of our finances. So you have the power to improve them.

The sooner you change your habits, the sooner they will become second nature.

Small changes now can have a lasting impact on your financial health.

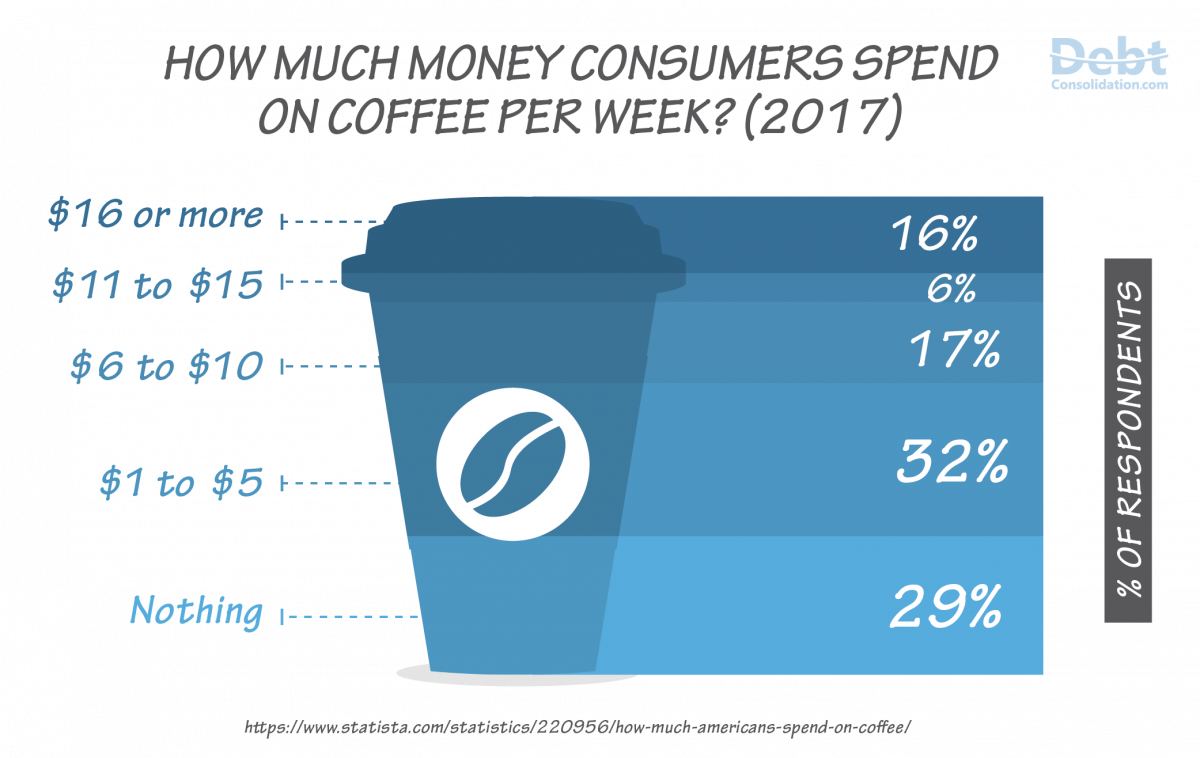

Starting a retirement fund will pay dividends years from now. Skipping your morning latte saves hundreds of dollars a year.

Start by calculating how much you earn and how much you spend. You’ve just laid the groundwork for a budget.

Budget in hand, you have the tools to control your cash flow, plan for the future, and adopt good habits.

Make a Budget and Stick to It

Budgeting is a plan for how to use your money strategically.

It’s not that complicated. Yet 60% of Americans don’t bother, according to the 2017 Consumer Financial Literacy Survey, published by the National Foundation for Credit Counseling.

It’s no coincidence that so many of us are in debt. The average American borrower owes $42,732 in mortgage payments, auto loans, student loans, and credit card bills.

Budgeting helps track your spending, save for retirement, and pay off loans. It forces you to plan ahead for a major purchase or a trip—without going into credit card debt.

The strategy for creating a budget depends on your preference. They all start by pulling out a calculator.

Figure out how much you earn after taxes (i.e., take-home pay)

Tally up your fixed monthly expenses. These include rent, insurance, transit pass, and loan payments.

Then factor in financial goals. Decide how much you want to put in your savings account, invest, or contribute to a retirement fund.

Now subtract fixed expenses and savings from your take-home pay. What’s left is your discretionary spending, like clothing or eating out.

Or, break down your budget according to the 50/30/20 method:

50% goes to necessities

20% goes to savings

30% is discretionary spending

Digital tools and apps simplify the whole process

With You Need a Budget (YNAB) you can create a monthly budget based on your income, spending habits, and savings goals.

One of the most popular services is Mint. It imports your bank account and credit card information and tells you how much you can spend based on your financial goals.

Whatever method you choose, creating a budget will keep your finances on track.

Get Financially Literate

Money is daunting, so some of us never bother to learn about it.

Only 37% of Americans could answer five basic finance questions in a survey by the FINRA Investor Education Foundation in 2016.

Financial literacy means understanding basic principles like what a checking account is and how credit cards work.

Learn basic financial principles. People who don’t understand these are more likely to end up broke.

Before the Great Recession, unwitting consumers took out sketchy mortgages that led to the financial crash.

People with poor credit took out subprime mortgages to buy a house, not realizing that the deal came with high-interest rates they couldn’t pay.

Yet 10 years later, the public is no more educated. According to a 2016 Allianz survey of 10,000 people in Western Europe, many still don’t understand finances or risk.

It found that people with high financial and risk literacy were twice as likely to make smart financial decisions.

Learn how to read the fine print. Before you sign for a loan or mortgage, you should understand how interest rates work.

A solid grasp of financial terms will help you understand these complicated documents and avoid surprises.

To start taking control of your finances, learn how money works and read a book on personal finance 101.

Track Your Spending

How often have you wondered where all your money went?

It’s not hard to find out. Just look at your receipts and credit card statements.

It can be shocking to see the numbers all laid out, so many people avoid it.

To take control of your finances, it is crucial to track your spending and know where your money goes.

Creating a budget helps you do this. When you become conscious of these patterns, you can control your spending.

Wait before you buy

Impulse purchases can wreak havoc on the most well-intentioned budgets.

To avoid buyer’s remorse, set rules for yourself. Promise to stick to a shopping list, for instance, or turn off one-click buying online.

Set a limit of, say, $50 on non-essential purchases. Then wait 48 hours to decide whether it’s worth the money.

For major expenditures, like a new car, do your homework first. Read reviews or consumer reports to see what the experts have to say.

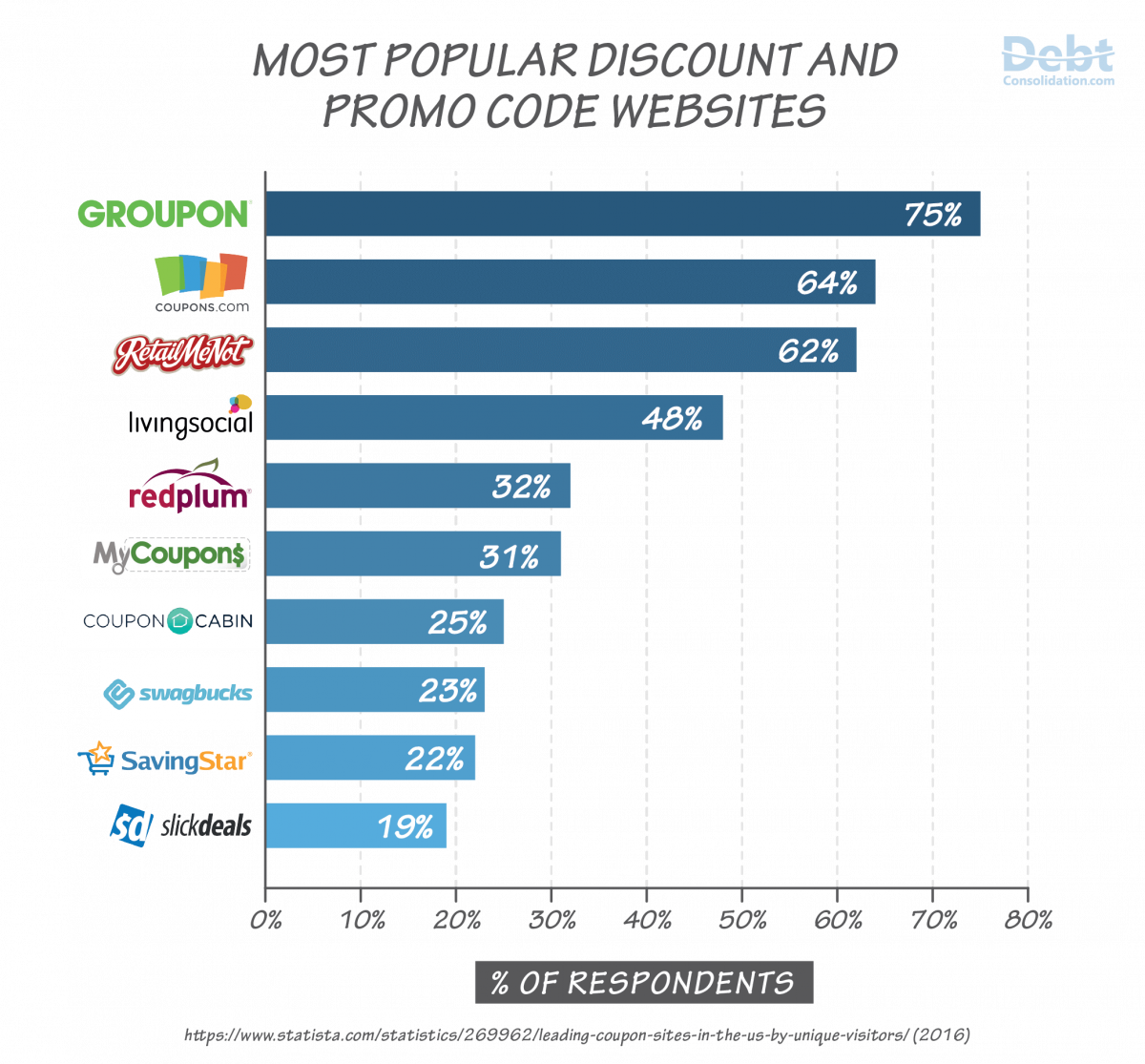

Hunt for bargains

In this age of promo codes and flash sales, it’s silly to pay full price.

There’s no need to clip coupons anymore. You can often find discount codes online—they’re just a quick search away.

Wait for sales. Some items are more likely to go on sale during certain times of the year, like mattresses in May or outdoor furniture in July.

You may end up buying things months in advance, but it will save money in the long run.

Look for Small Ways to Save

Don’t overlook the little ways you could save money on a daily basis. They add up over time.

A paperback book that costs $15 is free when you use the library. The library stocks DVDs and e-books as well.

The Department of Energy says you can save 10% on heating costs by turning down your thermostat 7-10 degrees for eight hours a day.

Programmable thermostats will do this for you automatically.

Skip the take-out

Many people allow themselves small treats, like coffee or take-out lunch. Yet multiply them by several months and they become four-figure expenditures.

In a big city, take-out costs $8-$10. That’s $40-$50 a week and around $2,000 a year. Packing lunch will save you a small fortune.

Plan your meals

Plan dinner menus to avoid costly (and often unhealthy) last-minute meals like take-out pizza.

When you go shopping, you will only buy the ingredients you need.

Menu planning may sound exhausting, but online tools make it easy. Plan to Eat lets you import online recipes, plop them on a calendar, and then automatically creates a shopping list.

Dinner leftovers also double as lunch. One night’s roast chicken becomes the next day’s chicken salad. You’ll save on two meals!

Build an Emergency Fund

An emergency fund is a pool of cash set aside for unexpected expenses: a job loss, surprise medical expense, or home damage.

You tap into the fund only when you are truly strapped, and not, I repeat NOT, to pay for a vacation.

Aim to save enough to cover three to six months of expenses (like rent and food).

Emergency planning is responsible

A rainy day fund helps prepare you for inevitable financial surprises.

Without one, you and your family could end up in a tailspin, saddled with debt.

You may have to borrow money from family, take out a payday loan, or rely on a credit card for basic purchases.

Yet many Americans lack any form of emergency savings. 53% don’t have enough to cover three months of expenses.

Set achievable savings goals

No amount is too little to save.

You can start by putting aside $1 a day. That may not sound like a lot, but it will add up to $365 after a year.

Put that into a high-interest savings account like Ally, which pays 1.25%, and you will earn an extra $5 a year.

Work those savings goals into your budget. Saving should be part of the plan, not an afterthought.

Regularly review your savings goals as well. If you get a raise, maybe you can set aside a bit more.

The more you contribute to your savings, the more it will grow.

If you save $5 a day, it will add up to $1,825 in a year and earn over $20 in interest. That’s enough to cover a typical out-of-pocket medical cost.

Automate Your Finances

Life becomes so much easier when you automate your finances. It removes human error and willpower from the equation, so you’re more likely to stick to your goals.

Set up and pay all your bills online

When you automate your bills, you never forget a payment.

Things like gym memberships, newspaper subscriptions, and phone bills can be charged automatically to your credit card or deducted from your bank account.

Automated payments are especially important with credit cards. When you miss a deadline, the credit card company charges a late fee. That gets added to your unpaid balance, which accumulates high interest.

Divert a portion of your income to savings

Take advantage of automatic paycheck deductions to divert a portion of your income to a savings account. Since you’ll never even see it, you won’t be tempted to spend it.

A smart way to do this is to open up a savings account that’s completely separate from your checking account.

This prevents you from easily transferring money between accounts.

You can also send money to an investment account or retirement fund. Whatever your financial goals, computers can help you stick to them.

Pay Off Debt

It’s hard to build wealth when you’re in the red.

Many people start their adult lives with debt and struggle to climb out of it. The average college graduate has some $30,000 in student loans.

It may sound daunting to repay debt, but it should be a top priority for anyone who wants control over their finances. Luckily there’s plenty of advice on how to get out of debt.

Use a debt reduction calculator to figure out how long this process will take. A credit counselor can offer guidance and help you come up with a plan.

Devise a strategy to pay off loans

There are two primary methods for tackling debt.

Start by paying off high-interest loans first. If you have multiple loans, rank them in order of interest rate. You want to pay those with the highest interest rates (like credit cards) first.

Another option is the "snowball method." Rank your loans from smallest to largest and pay off the smallest ones first.

The theory is that when you get rid of one loan, it builds momentum to pay others.

Whichever strategy you choose, put as much as you can towards paying off your loans. The longer it takes to do, the more you will shell out in interest.

Try to make more than the minimum payment each month. Consider automating loan repayments so it goes directly from your paycheck.

Put any extra money, like a tax return, towards paying the debt.

Or consider a debt consolidation loan. This pools your loans together so you make only one payment each month, often at a lower interest rate.

Stay out of debt

Once out of debt, stay out of debt.

Learn from past mistakes and examine how you got into debt in the first place.

If you tend to overspend with credit cards, use cash for more transactions and limit yourself to one credit card.

Use your money wisely. With a budget and savings account, you can be smart about how you manage your money.

If you have an emergency fund, you won’t have to rely on payday loans or credit cards.

Open Up About Money

Money is taboo in America. You’re more likely to know about a friend’s sex life than her salary.

Money is a major source of stress in relationships, yet couples are often uncomfortable broaching the subject.

It’s a bad idea to shut down this conversation. Opening up about money can improve our financial well-being as well as our relationships.

Talk about your financial struggles

It’s hard to tackle debt or build emergency savings alone. Enlist support from a trusted friend who will root for you and hold you accountable.

If friends know that you are focused on paying off student loans, they might not tempt you with an invitation to an expensive restaurant.

In a relationship, be open about your goals. Your partner can support you and provide a check when you’re deciding on a major purchase.

You can also join a get-out-of-debt support group like Debtors Anonymous.

Hire a financial advisor

A financial advisor can help you with big decisions like opening a college fund and planning for retirement.

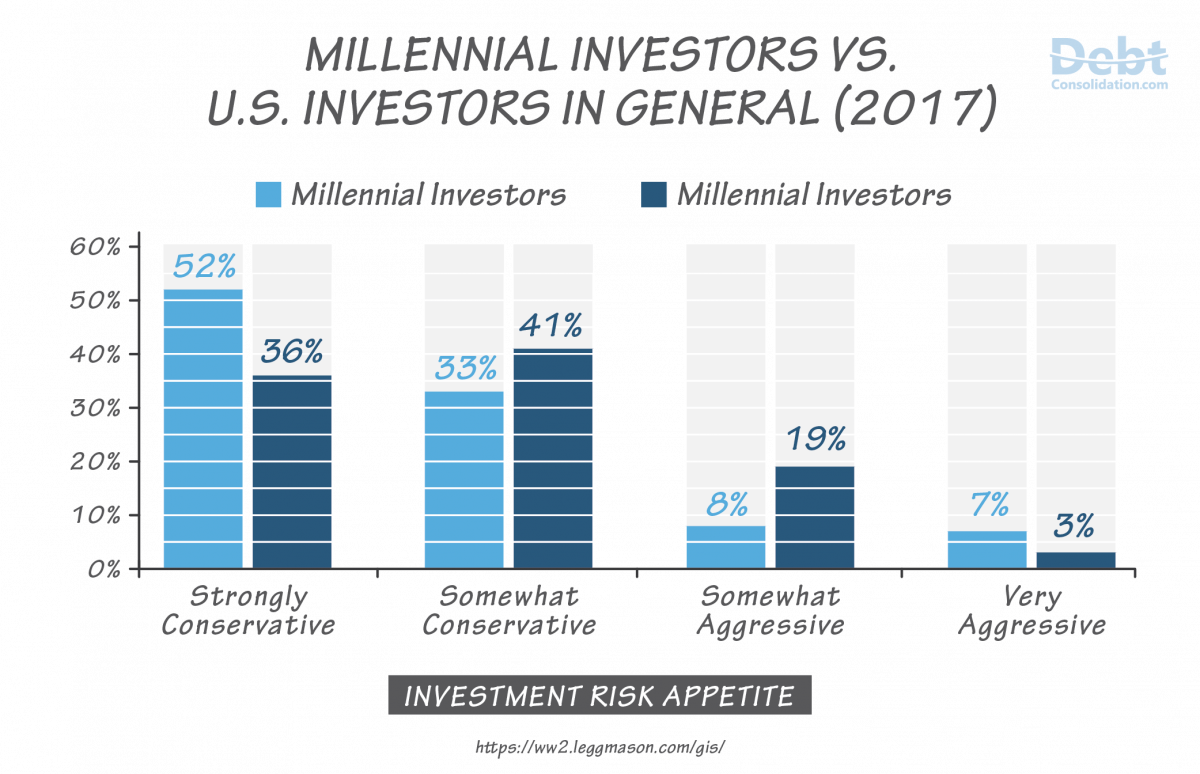

You should discuss short-term and long-term goals, your spending habits, risk tolerance, and insurance needs.

However, hiring a financial advisor costs money, so you’ll have to weigh whether it’s worth it for you. It’s especially useful when you’re nearing retirement or starting a family.

Use Credit Cards Wisely

Credit cards are essentially interest-free loans—when used properly.

By putting purchases on the card, you borrow money and pay no interest for a month.

If you’re savvy, you can also earn cash back, free flights, and other rewards.

Credit cards are only useful if you pay the balance each month. Only use them for things you can actually afford.

Otherwise, you will pay ridiculously high-interest rates (as much as 22%) on the money you owe.

Many Americans play right into the hands of credit card companies. The average family carries $8,377 in credit card debt.

Ignore the minimum amount due on your bill and pay off the entire balance. Set up automatic payments so you never miss a payment.

If you do rack up unpaid balances, pay them down as soon as possible.

When you get your bill, read it line-by-line. Don’t just look at the total balance, but examine statements for errors or suspicious activity.

Focus on Your Physical and Mental Health

Money is an intrinsic part of our everyday lives. It stands to reason that our personal habits affect our spending habits.

Be healthy. Your health and financial well-being are linked. Having too much debt can strain our relationships and hurt our mental health.

Healthy personal habits predict smart financial habits and vice versa

A Duke University study found that low credit scores predict the risk of cardiovascular disease.

Similarly, people who contribute to a 401(K) are more likely to improve their health, according to researchers at Washington University in St. Louis.

Poor health does not cause poor financial decisions, but people who exercise tend to be disciplined in other areas of their life.

There’s a ripple effect.

Exercise improves cognitive function and energy levels, reduces stress, and helps you get a good night’s sleep.

All of these factors make you productive at work, affecting your earning potential.

Think long-term

Visualize your goals. Think about what you want in life and where you want to be in 30 years.

It’s easier to create a financial roadmap if you have a destination in mind.

This means thinking long term and not looking for quick wins. Take steps to plan for retirement and make investments that will pay dividends years from now.

Avoid thinking only about the short term, which fuels emotional decisions. It’s a long game.

Watch Your Credit Score

A credit score is like your personal financial grade. The higher the score, the better the grade.

Anything over 740 is considered Excellent. Below 600 is Bad.

When you take out a loan, mortgage, or credit card, the issuer will check your credit score.

If you have poor credit, lenders will reject you or charge high interest.

Your credit score also affects whether you can rent an apartment or get a cell phone plan.

You should know your credit score and, if necessary, take steps to improve it.

Check your credit report

Your credit score is based on your credit report, so you should know what’s on there.

By law, you can request a free copy of your credit report once every 12 months from each of the three main credit reporting agencies: Equifax, Experian, and TransUnion.

You can check it on Annualcreditreport.com.

Now, check your credit report for errors. There’s a good chance you’ll find something.

Look for accounts you never opened or an address you have never lived at. If you find an error, report and dispute it.

Repair your credit

There are several steps you can take to improve your score.

Pay bills on time. Your payment history makes up 35% of your credit score.

Bills for utilities, doctors, and credit cards all factor in. Set up reminder alerts or automatic payments to be sure you make deadlines.

Don’t put too much on credit cards. Another 30% of your score is made up by your credit utilization, meaning how much of your available credit you have used.

Aim to use no more than 30% of your limit. If you have a $10,000 limit on your credit card, spend less than $3,000 each month.

Don’t close old accounts. The length of your credit history factors in, so you want to show that you’ve been paying bills on time for years.

While it may be tempting to cut up old cards, don’t cancel them right away. It may be better to hold onto your older card than sign up for new ones.

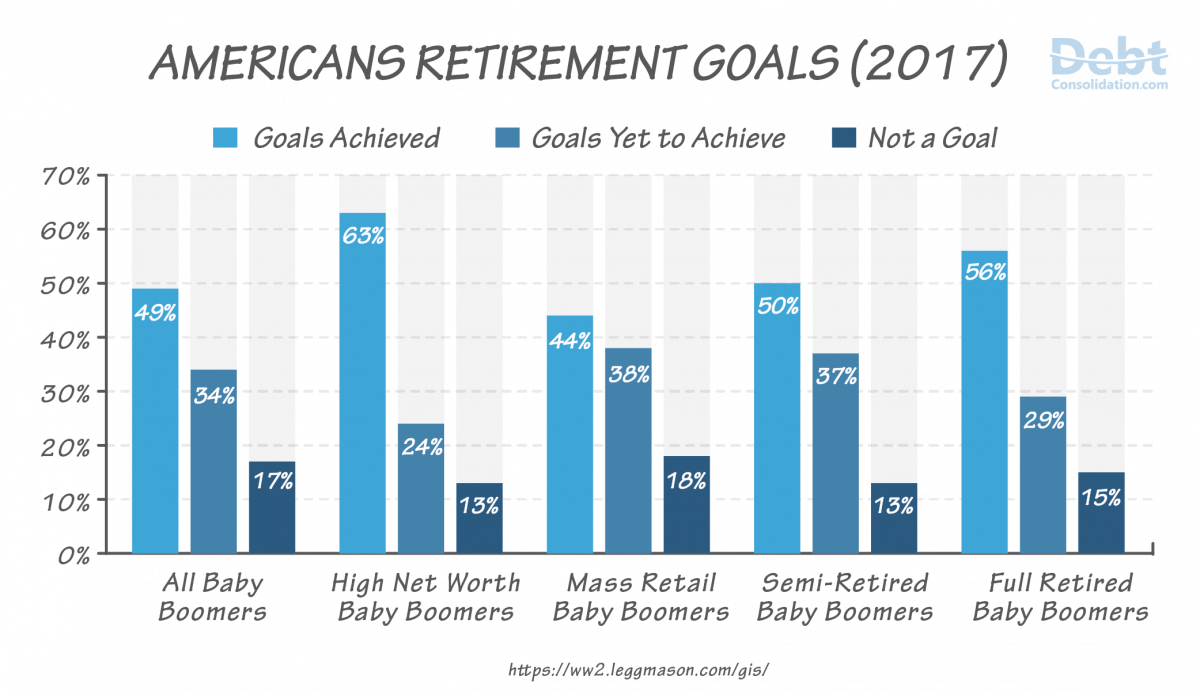

Save for Retirement Now

Retirement is rarely top of mind when you’re in your 20s, so many people neglect to start saving. Bad move.

The earlier you start saving for retirement, the more you will have when you’re 65. The more time your money has to grow, the more you will accumulate.

Here’s a sample scenario, assuming the market average of 7% returns.

If you invest $100 per year starting at age 25, you will contribute $4,000 over 40 years. When you’re 65, that money will have grown to $19,963.

Let’s say you start at 35 but contribute twice as much, $200 a year, for a total of $6,000 over 30 years. You’ll end up with less money: $18,892 at age 65.

It’s important to save for retirement at any age, even if you start late.

Robo-advisors to the rescue

You don’t have to be a Wall Street expert to know how to invest.

Thanks to technology, you can save for retirement and big ticket items like a home or your kid’s education by using a robo-advisor.

A robo-advisor is simply a piece of software that helps you invest just as a financial planner or wealth manager would.

The beauty of a robo-advisor is that they’re easier, just as effective (if not more), and cheaper!

Some good companies that use robo-advisor technology are Betterment, Wealthfront, and Charles Schwab.

These companies will also help you open the type of accounts we recommend below – like an IRA – and get you started investing in the stock market.

Open an IRA

The smart way to save for retirement is with an IRA, which does not tax your investment returns. You can contribute up to $5,500 but you can’t withdraw money until you’re 50.

There are two types of IRAs: A traditional IRA and a Roth IRA.

Contributions to a traditional IRA are tax-deductible. But you get taxed when you withdraw money in your 70s.

You are required to withdraw money when you are 70 ½, at which point you can no longer make contributions.

A traditional IRA is good for people who could use a large tax deduction now. It may allow you to contribute more when you are young since you’re not paying any of it in taxes.

It’s best if you think your tax bracket will be the same or less when you hit retirement age.

Contributions to a Roth IRA are not deductible and will be taxed normally. But you will not be taxed when you withdraw money.

There are no age limits on when you have to start withdrawing money, so your investments can continue to grow.

A Roth IRA is best if you don’t need the tax deduction now and think you will be in a higher income bracket when you retire.

Enroll in a 401(K) plan

A 401(K) is an employer-sponsored retirement savings plan.

Employees automatically contribute a portion of their paycheck to invest. Some employers will match your contributions.

You only pay taxes when you withdraw money.

You can contribute up to $18,500 per year. Aim to increase your contributions consistently, especially if you get a raise.

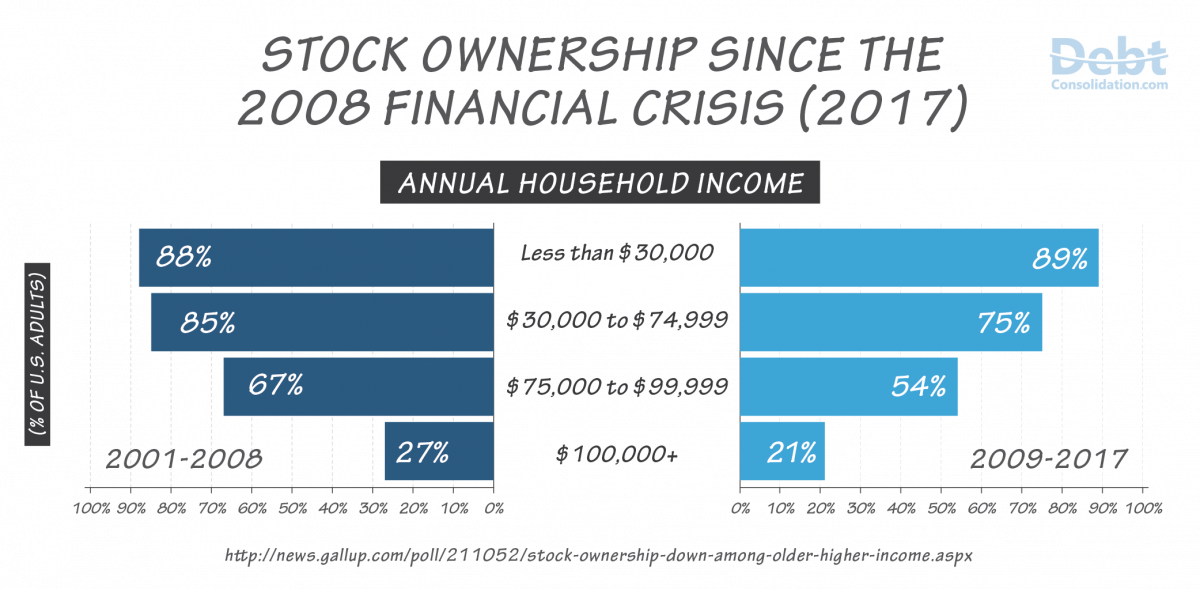

Invest in the Stock Market

Given the ups and downs of the markets, buying stocks may seem like a risky investment.

But in general, the stock market goes up. Over the long term, you get a great rate of return on investments.

Despite recessions, the Dow Jones and S&P 500 have trended steeply up over the last century.

When buying stocks, think like Warren Buffett and make long-term investments. Don’t pay attention to the immediate rate of return, but allow time for companies to grow.

Invest in index funds

If you’re a novice, don’t buy individual stocks. Instead, spread out your risk by investing in index funds.

Index funds are a collection of stocks on a market index, such as the S&P 500. If you have an S&P index fund, your returns will match those on the S&P.

Buy a stock that pays dividends

If buying individual stocks, focus on ones that pay dividends. Dividends are small cash payments that go to shareholders.

Dividend-paying stocks tend to be well-established companies that are relatively low-risk, such as Coca-Cola.

When you get dividends, reinvest them by purchasing more stock. This will generate more dividends, compounding your investment.

Invest what you can

You don’t need a lot of money to buy stocks. Invest whatever you can and start building wealth.

Micro-investing apps like Acorns allow you to contribute small sums. Linked to your credit card, it rounds up purchases to the nearest dollars and invests that spare change.

Buy Insurance

It can be tempting to forgo insurance to save a little money. This is short-sighted and can lead to financial ruin.

What insurance you need depends on your situation, but everyone should have health insurance.

Health insurance

According to a 2013 study, about 20% of personal bankruptcies are caused by medical debt. Those who file for bankruptcy have an average of $8,594 in medical debt.

Yet many Americans go without health insurance. According to the Kaiser Family Foundation, 27.6 million Americans were uninsured in 2016.

Health insurance is available through employers or on a government Health Insurance Marketplace.

Low-income Americans can get coverage through Medicaid or the Children’s Health Insurance Program. Older Americans can use Medicare.

Other forms of insurance

Depending on your situation, you may need other kinds of insurance too.

If you own a house, you’ll want homeowners’ insurance. This protects your property from fire and flooding damage, as well as vandalism and theft.

Fire and lightning can cause a whopping $43,000 in damage; water damage runs over $8,000.

Renter’s insurance, auto insurance, and disability insurance are other common plans.

You can start building good financial habits today

Financial health is in your control. Identify areas you could improve and start making changes now.

Call a financial advisor, research your company’s 401(K) plan, or start working out your budget. You’ll see it’s not that complicated.

Make good financial habits second nature.

This may take time, but if you have a plan and set rules for yourself, you’ll set a new pattern of smart behavior.

Do you have any invaluable "money" habits we’ve missed?

Let everyone know in the comments below!