Updated: Sep 16, 2021

How to Get Out of Debt

Estimated read time: 7 minutes

What is Debt?

Debt is simply the amount of money or property that one party owes to another party. The parties can be individuals, corporations, municipalities or even governments. Consumer debt (or outstanding consumer credit) is the amount owed by a consumer to a merchant or service provider. This debt includes everything from credit cards to mortgage loans.

The average U.S. consumer owes more than:

- $15,112 in credit card debt

- $146,215 in mortgage debt

- $31,240 in student loan debt

The total U.S. consumer debt is $11.4 trillion dollars.

Problem Debt

Not all debt is bad; many financial experts define debt as either good or bad, depending on how it is used.

The following are a few articles that describe the differences between the two.

- CNN Money: Good versus Bad Debt

- Forbes Online: Good Debt Bad Debt

- About.com: Good Debt vs. Bad Debt

Why So Much Debt?

Debt happens for a variety of reasons.

To begin with, many transactions only happen through the use of credit – whether revolving credit, secured and unsecured loans or other lines.

Using debt allows people to purchase items that would otherwise be out of reach.

Problem debt, however, happens when payments can't be made.

When individuals are laid-off, sick or otherwise financially unable to make payments, this debt adds up to unsustainable levels. Homes, jobs and even health can all be lost.

Getting Out of Debt

One of the biggest challenges in life can be to get out of debt, especially since the economy is largely debt-based.

The easiest way to make this happen is to earn more money, receive an inheritance or win the lottery. However, these are not reliable options.

Many people look for professional help to get them through their situation. After all, being in debt is traumatic.

This help can come from legal professional, credit counselors or debt relief providers and often include:

- Bankruptcy

- Debt Settlement

- Credit Counseling

- Debt Consolidation

While many strategies can be used, depending on the unique needs of the individual, the primary categories include debt reduction, debt management and debt consolidation.

Debt Reduction

Debt reduction services usually offer financial counseling and debt management assistance for consumers. This includes assistance with budgeting, planning and saving.

Credit.com offers a "DIY" plan for reducing debt, and Fox Business suggests strategizing a payback plan and sticking to it.

About.com lists other helpful "smart money moves" for consumers to get out from under debt.

Debt reduction calculators, such as the CNN debt reduction calculator, can help consumers figure out when they will be debt free and how much they will pay in interest by paying just the monthly minimums.

"Do it Yourself" Debt Reduction Strategies:

- The Every Girl

- CoupleMoney.com

- NoMoreDebts.org

- PersonalFinance.byu.edu

- CNN Money

- LifeHacker.com

- The Motley Fool

- Century Negotiations Inc.

- AccumulatingMoney.com

- Everyday Simple Living

- Debt Consolidation Care

- CreditCards.com

- RealSimple.com

Fee-based and Nonprofit Debt Reduction Companies and Services:

- DebtReductionServices.org

- Better Business Bureau

- Our Credit Counseling Services

- MoneyManagement.org

- Alliance Credit Counseling

- In Charge Debt Solutions

Debt Management

Debt management companies are similar to debt relief companies, but they are not quite the same.

The most common type of debt management company is a credit counseling firm.

Credit counseling firms help people set budgets and often set up debt management plans.

A debt management plan (DMP) will take one monthly bill payment from a consumer and allocate it to all creditors that are owed money that month.

Financial expert Dave Ramsey states that typically, the debt management companies will negotiate lower payments and interest rates with creditors in advance, which is why they are able to spread one payment into many.

Usually, debt management companies will run an income and expenditure test on a household to see how much can be allocated towards debt each month.

Some organizations are non-profits that charge at no or non-fee rates, while others can be quite expensive, according to a report by the Federal Trade Commission.

Knowing the basics of how these companies work is important in order to pick the most appropriate debt management plan.

Non-profit and for-profit organizations offering debt management plans:

- Money Management International

- Green Path Debt Solutions

- ConsumerCredit.com

- In Charge Debt Solutions

- Consumer Credit Counseling Services

- Balance Financial Fitness Program

- Clear Point Credit Counseling Solutions

- Step Change Debt Charity Counseling Services

- CredAbility Nonprofit Credit Counseling and Education

- Lutheran Social Services of Minnesota Financial Counseling

- PayPlan Debt Help and Advice

- CareOne Debt Relief Services

- Debt Management Credit Counseling Corp.

Debt Consolidation

Debt consolidation is the act taking out one large loan to pay off several other loans.

Multiple unsecured debts are consolidated into one monthly payment — usually at a lower interest rate.

See If You Qualify for a Personal Loan up to $250k

Only unsecured debts are eligible for debt consolidation, that is, loans not backed by an asset such as credit card, medical, and utility bills or student loans.

Most consumers who choose to consolidate their debt are looking to either reduce their monthly payments or hasten their debt repayment.

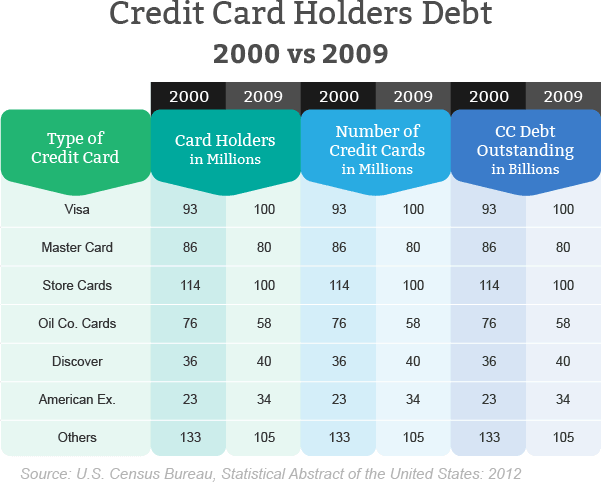

Credit Card Debt

Credit card debt is one of the most common types that consumers owe and is eligible for consolidation.

When you obtain a consolidation loan, all credit card debt will be lumped into one loan or payment. Consolidating credit card debt does not eliminate any portion of what is owed.

CreditCards.com released "9 Things You Must Know about Credit Card Consolidation" to explain the process.

There are both consolidation programs and loans in order to consolidate credit card debt.

Credit scores are a factor when lenders are considering granting a consolidation loan.

There are balance transfer credit cards available, which allow a consumer to put all credit card debt onto one card and self-consolidate.

A consumer might be able to use one of the cards that they already own, as long as there is enough available credit to accommodate for all other debt.

Other resources for credit card debt consolidation include:

- BankRate.com

- About.com: Credit

- LifeHack.org

- LifeHacker.com

- WikiHow

Student Loans

Student loan debt continues to be a major and growing portion of U.S. consumer debt.

When considering whether or not to consolidate your student loans, using the Federal Student Aid's consolidation checklist can be helpful.

Since not every type of student loan can be consolidated, you should learn which loans are eligible and which aren't.

The interest rate on a consolidated student loan will be fixed for the life of the loan, although the rate generally should not be higher than 8.25%.

The repayment period is typically between 10 and 30 years.

Sometimes when you consolidate student loans, you'll have the option to repay them on an income-based repayment plan.

For more articles, how-to's, services, and information on consolidating student loans access the following resources:

- Federal Direct Consolidation Loans Information Center

- FinAid.org: The SmartStudent Guide to Student Loan Consolidation

- Wells Fargo Private Student Loan Consolidation Services

- Forbes: Tips on Consolidation Student Loans

- CuGrad: Private Student Loan Consolidation

- Suze Orman's Advice on Consolidating Student Loans

- US News: 4 Reasons to Consolidate your Student Loans

- BankRate.com: What to Know about Consolidating Student Loans

- StudentLoans.gov: Special Direct Consolidation Loans

- Fox Business: What to Know Before Consolidating Student Loans

Company Ratings and Reviews

When searching for a company to help you with debt consolidation, reading reviews of the services they offer is highly recommended.

Although online reviews can be one-sided, it is usually in the consumers best interest to avoid companies with poor ratings.

The following resources rank and rate companies nationwide:

- 2013 Best Debt Consolidation Services Reviews

- Debt Consolidation Company Reviews and Information

- Top Consumer Reviews of Debt Relief Companies

- Consumer Affairs Freedom from Debt Relief User Reviews & Complaints

- Debt Relief of America Complaints & Reviews

- Spring Leaf Financial Services Reviews

- Christian Debt Relief Reviews

- DailyStrength.org User Reviews on Debt Consolidation

- Debt Consolidation Programs: Where to Find the Best Deal

- Better Business Bureau: National Debt Relief Review

If you're looking for more ways to get yourself out of debt, check out our 4 Keys to Getting Out of Debt.